Growing Need for Operational Efficiency

In the current business landscape, the Ai Video Analytic Market is propelled by the growing need for operational efficiency. Organizations are increasingly leveraging AI video analytics to streamline processes, reduce costs, and enhance productivity. By automating surveillance and data analysis, businesses can allocate resources more effectively and focus on core activities. For instance, in the retail sector, AI-driven analytics can optimize inventory management and improve customer service by analyzing foot traffic patterns. The potential for cost savings and improved operational workflows is substantial, with studies indicating that companies utilizing AI technologies can achieve up to a 20% reduction in operational costs. As organizations seek to remain competitive, the demand for AI video analytics solutions is likely to rise, further driving growth in the Ai Video Analytic Market.

Integration with Smart City Initiatives

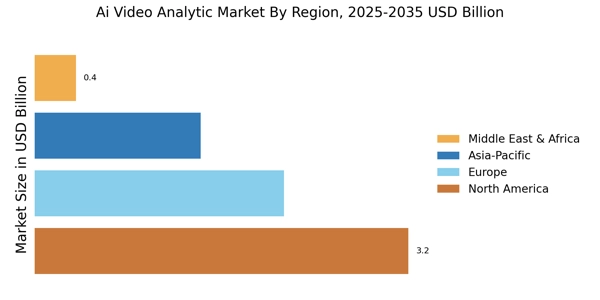

The Ai Video Analytic Market is increasingly intertwined with smart city initiatives, as urban areas seek to enhance public safety and improve infrastructure management. The integration of AI video analytics into city surveillance systems allows for real-time monitoring of traffic, crowd behavior, and emergency response. This synergy is expected to facilitate better resource allocation and improve the overall quality of life for residents. As cities invest in smart technologies, the market for AI video analytics is projected to grow, with estimates suggesting a potential increase in market size by 25% over the next five years. The collaboration between municipal authorities and technology providers is crucial in realizing the full potential of AI video analytics in urban environments, thereby driving innovation within the Ai Video Analytic Market.

Advancements in Machine Learning Algorithms

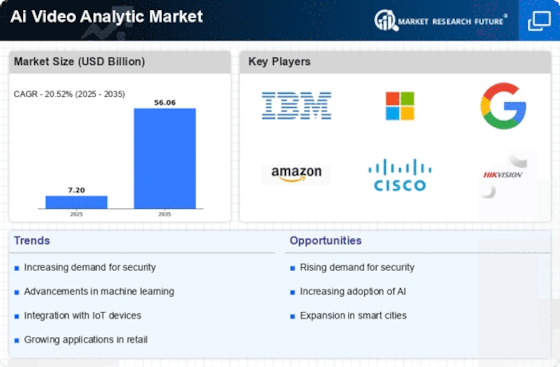

The Ai Video Analytic Market is significantly influenced by advancements in machine learning algorithms. These innovations enhance the accuracy and efficiency of video analytics, enabling systems to process vast amounts of data in real-time. As machine learning techniques evolve, they allow for improved object recognition, behavior analysis, and predictive analytics. This evolution is crucial for sectors such as retail, transportation, and public safety, where timely insights can lead to better decision-making. The market is expected to witness a compound annual growth rate (CAGR) of over 30% in the coming years, driven by the increasing sophistication of AI algorithms. Consequently, organizations are more inclined to invest in AI video analytics solutions, recognizing their potential to transform operational efficiency and customer experiences. The continuous refinement of these algorithms is likely to propel the Ai Video Analytic Market to new heights.

Rising Demand for Enhanced Security Solutions

The Ai Video Analytic Market experiences a notable surge in demand for advanced security solutions. Organizations across various sectors are increasingly adopting AI-driven video analytics to bolster their surveillance capabilities. This trend is driven by the need to enhance public safety and mitigate risks associated with crime and vandalism. According to recent estimates, the market for video surveillance is projected to reach USD 75 billion by 2026, with a significant portion attributed to AI technologies. The integration of AI in video analytics allows for real-time threat detection, anomaly recognition, and improved incident response, thereby transforming traditional security measures into proactive systems. As security concerns escalate, the Ai Video Analytic Market is poised for substantial growth, with businesses investing in sophisticated technologies to safeguard their assets and ensure the safety of their environments.

Increased Focus on Data Privacy and Compliance

As the Ai Video Analytic Market expands, there is an increasing focus on data privacy and compliance with regulations. Organizations are becoming more aware of the legal implications of video surveillance and the ethical considerations surrounding data collection. This awareness is prompting businesses to adopt AI video analytics solutions that prioritize data protection and adhere to regulatory standards. The implementation of privacy-centric technologies, such as anonymization and secure data storage, is becoming essential for companies aiming to maintain consumer trust. Furthermore, compliance with regulations such as GDPR is influencing the design and deployment of AI video analytics systems. As a result, the market is likely to see a shift towards solutions that not only enhance security but also respect individual privacy rights, thereby shaping the future landscape of the Ai Video Analytic Market.