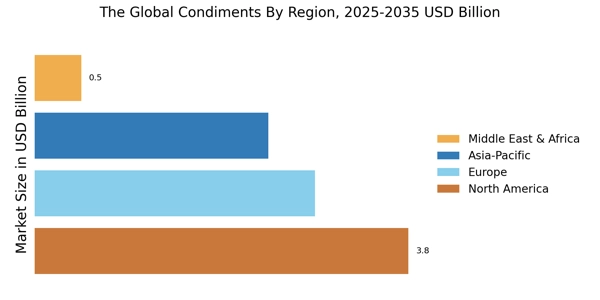

By Region, the study provides market insights into Europe, North America, Asia-Pacific and the Rest of the World. Asia Pacific condiments market accounted for USD 3.8 billion in 2021 and is expected to exhibit a significant CAGR of 41.6 percent growth during the study period. In addition, the region is expected to grow at the quickest rate in the next years. Consumption of condiments, sauces, and dressings is increasing significantly in nations such as China, Japan, India, Taiwan, and Indonesia due to the region's growing popularity of traditional foods.

Furthermore, as demand for cuisines grows in India and Indonesia, prominent manufacturers are introducing new items. ORCO, also known as Organic Seasonings, an Indian-based company, debuted 32 new products in its broad array of 100 percent natural, healthful, and certified organic seasonings and spices in January 2021. Moreover, China's condiments industry held the largest market share, and the Indian market for condiments was the fastest-growing market in the Asia-Pacific region.

Further, the major countries studied in the Condiments Market report are the U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: CONDIMENTS MARKET SHARE BY REGION 2021 (%)

Europe holds the second-largest share, supported by strong demand in the france condiments market. More consumers are selecting healthier living, new flavor profiles, and packaging ease in the United Kingdom. The condiments industry demand is increasing moderately due to the consistent entry of international cuisines led by the tourist and hospitality industries. In 2021, there will be over 96.8 million visitor arrivals in German travel accommodations. Seasonings such as pepper account for more than 50% of Russian exports in 2021, according to the Centre for the Promotion of Imports; coriander accounts for 19%, and cinnamon accounts for 11.1%.

The remaining 18 types of spices contribute to at least 2% of the total export. Further, the German market for condiments held the largest market share, and the UK market of condiments was the fastest-growing market in the European region.

North America continues to experience stable growth, while Latin America is witnessing increased adoption led by the Brazil condiments market. Regional diversification is strengthening the global condiments market share. In addition, new enterprises are cropping up in the United States and Canada to use spices for purposes other than flavoring food, which is projected to fuel the industry in the coming years. The rising popularity of convenience and ready-to-eat foods, as well as the rising desire for ethnic cuisines, have all contributed to the regional Condiments Market expansion. Processed foods account for about 70% of the American diet.