Advancements in UAV Technology

Technological advancements play a crucial role in shaping the Commercial UAV Market. Innovations in battery life, payload capacity, and autonomous navigation systems are enhancing the capabilities of UAVs, making them more appealing for various applications. For instance, the development of hybrid UAVs that combine electric and fuel-based power sources is expected to extend flight durations and operational range. Furthermore, the integration of artificial intelligence and machine learning algorithms is enabling UAVs to perform complex tasks with greater efficiency. Market data suggests that the UAV technology sector is experiencing rapid growth, with investments in research and development expected to reach billions of dollars in the next few years. These advancements not only improve the performance of UAVs but also expand their potential applications across industries such as agriculture, construction, and surveillance.

Increased Investment and Funding

Investment in the Commercial UAV Market is on the rise, driven by the growing recognition of UAVs' potential across various sectors. Venture capital and private equity firms are increasingly funding startups and established companies that are developing innovative UAV technologies and applications. This influx of capital is likely to accelerate research and development efforts, leading to the introduction of advanced UAV solutions. Recent reports indicate that funding for UAV-related ventures has reached unprecedented levels, with billions of dollars being allocated to projects focused on enhancing UAV capabilities and expanding their market reach. As investment continues to flow into the sector, it may foster a competitive environment that encourages innovation and drives down costs, ultimately benefiting end-users and expanding the overall market.

Regulatory Support and Frameworks

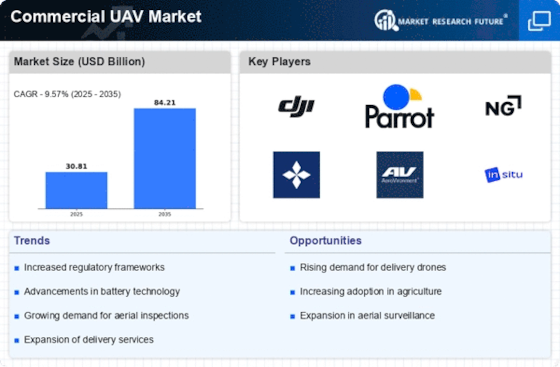

The establishment of supportive regulatory frameworks is a significant driver in the Commercial UAV Market. Governments are increasingly recognizing the potential of UAVs and are working to create regulations that facilitate their safe integration into airspace. This includes the development of guidelines for commercial operations, which are essential for ensuring public safety and fostering innovation. Recent initiatives have seen various countries implementing streamlined processes for UAV registration and operational approvals, which could potentially accelerate market growth. As regulatory bodies continue to adapt to the evolving landscape of UAV technology, the Commercial UAV Market is likely to benefit from increased clarity and reduced barriers to entry for new operators. This supportive environment may encourage investment and innovation, further propelling the market forward.

Growing Applications Across Industries

The versatility of UAVs is driving their adoption across a multitude of industries, which serves as a key driver in the Commercial UAV Market. From agriculture to construction, UAVs are being utilized for tasks such as crop monitoring, site surveying, and infrastructure inspection. The agricultural sector, in particular, is witnessing a surge in UAV usage for precision farming, where data collected by drones can lead to improved crop yields and resource management. Market analysis indicates that the agricultural UAV segment is expected to grow significantly, with projections suggesting a market size of several billion dollars by the end of the decade. This diversification of applications not only enhances the market's resilience but also opens new avenues for innovation and investment, making it a dynamic and evolving sector.

Increased Demand for Delivery Services

The rise in e-commerce has led to a notable increase in demand for efficient delivery services, which is a key driver in the Commercial UAV Market. Companies are increasingly adopting UAVs to enhance their logistics capabilities, as these unmanned aerial vehicles can significantly reduce delivery times and operational costs. According to recent data, the use of UAVs in delivery services is projected to grow at a compound annual growth rate of over 20% in the coming years. This trend is particularly evident in urban areas where traffic congestion poses challenges for traditional delivery methods. As businesses seek to improve customer satisfaction and streamline operations, the integration of UAVs into their delivery systems appears to be a strategic move that could reshape the logistics landscape.