Expansion into Emerging Markets

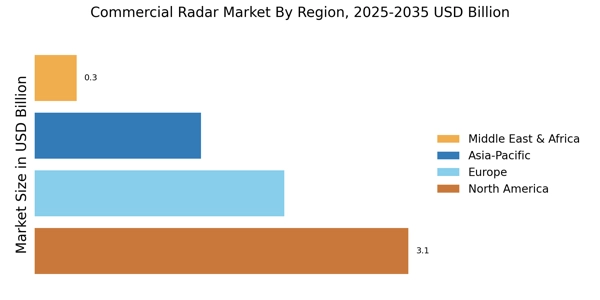

The Commercial Radar Market is witnessing significant expansion into emerging markets, where infrastructure development and modernization efforts are gaining momentum. Countries in Asia-Pacific and Latin America are increasingly adopting radar technologies for applications in transportation, weather monitoring, and environmental management. This trend is fueled by government initiatives aimed at enhancing public safety and improving disaster response capabilities. As these regions invest in radar systems, the market is expected to see a substantial increase in demand, potentially leading to a market size of USD 8 billion by 2026. The expansion into these markets presents lucrative opportunities for manufacturers and service providers.

Growing Demand for Security Solutions

In recent years, there has been a marked increase in the demand for security solutions across various sectors, including defense, transportation, and critical infrastructure. The Commercial Radar Market is responding to this trend by providing advanced radar systems that enhance surveillance and threat detection capabilities. Governments and private entities are investing heavily in radar technologies to bolster national security and protect assets. This heightened focus on security is expected to drive market growth, with estimates suggesting that the sector could reach a valuation of USD 10 billion by 2027. The need for reliable and efficient security solutions is likely to remain a key driver in the coming years.

Regulatory Support and Standardization

Regulatory support and standardization play a pivotal role in shaping the Commercial Radar Market. Governments are increasingly recognizing the importance of radar technologies for safety and security, leading to the establishment of supportive policies and regulations. Standardization efforts are also underway to ensure interoperability and compatibility among different radar systems. This regulatory environment is fostering market growth by encouraging investments and facilitating the adoption of radar technologies across various sectors. As a result, the market is anticipated to grow steadily, with a projected increase in demand for compliant radar systems, potentially reaching USD 9 billion by 2028.

Technological Advancements in Radar Systems

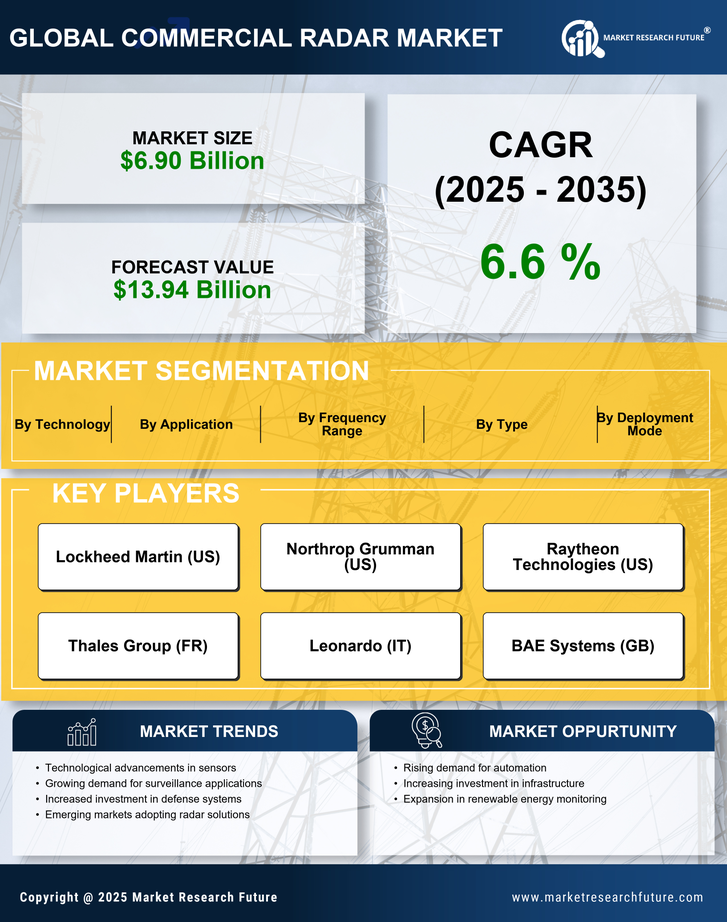

The Commercial Radar Market is experiencing a surge in technological advancements, particularly in radar signal processing and data analytics. Innovations such as phased array radar and synthetic aperture radar are enhancing detection capabilities and resolution. These advancements are not only improving the performance of radar systems but also reducing costs associated with manufacturing and maintenance. The integration of artificial intelligence and machine learning into radar systems is further driving efficiency and accuracy. As a result, the market is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, indicating a robust demand for advanced radar technologies.

Increased Investment in Research and Development

Investment in research and development is a critical driver for the Commercial Radar Market, as companies strive to innovate and stay competitive. Enhanced R&D efforts are leading to the development of next-generation radar systems that offer improved performance and versatility. This focus on innovation is particularly evident in sectors such as automotive, where radar technology is essential for advanced driver-assistance systems. The market is likely to benefit from increased funding from both public and private sectors, with projections indicating that R&D spending in radar technologies could exceed USD 1.5 billion by 2025. This investment is expected to yield new applications and enhance existing products.