Rising Energy Costs

The rising costs of traditional energy sources are prompting businesses to seek alternative solutions, thereby driving the Commercial Industrial PV Inverter Market. As energy prices continue to escalate, companies are increasingly looking towards solar energy as a cost-effective alternative. In 2025, energy costs are projected to rise by approximately 5% annually in many regions, making solar energy systems more attractive. This economic pressure encourages industries to invest in PV inverters, which are essential for harnessing solar energy. The potential for long-term savings on energy bills is a compelling factor for businesses, leading to a surge in demand for commercial solar installations and, consequently, the Commercial Industrial PV Inverter Market.

Government Incentives and Policies

Government incentives and policies aimed at promoting renewable energy adoption significantly influence the Commercial Industrial PV Inverter Market. Various countries have implemented tax credits, rebates, and grants to encourage businesses to invest in solar energy systems. For instance, in 2025, several regions are expected to enhance their support for solar energy through favorable legislation, which could lead to a substantial increase in installations. These incentives not only lower the initial investment costs but also improve the return on investment for companies adopting solar technology. As a result, the Commercial Industrial PV Inverter Market is poised for growth, as more businesses take advantage of these financial benefits to transition to renewable energy sources.

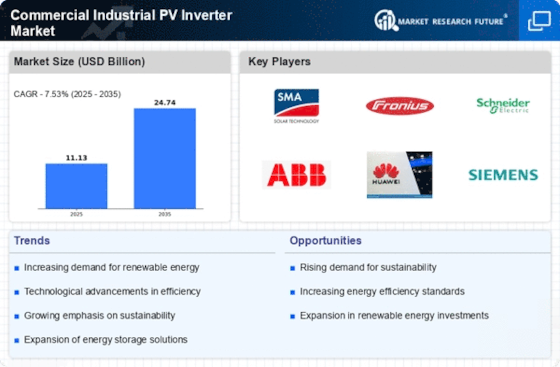

Increasing Demand for Renewable Energy

The rising demand for renewable energy sources is a primary driver of the Commercial Industrial PV Inverter Market. As businesses and industries seek to reduce their carbon footprints, the adoption of solar energy systems has surged. In 2025, the global solar energy capacity is projected to reach over 1,200 GW, indicating a robust growth trajectory. This shift towards renewable energy is not merely a trend but a fundamental change in energy consumption patterns. Consequently, the demand for efficient and reliable PV inverters is expected to increase, as they play a crucial role in converting solar energy into usable electricity. The Commercial Industrial PV Inverter Market is likely to benefit from this growing emphasis on sustainability, as more companies invest in solar technology to meet regulatory requirements and consumer expectations.

Growing Corporate Sustainability Initiatives

The growing emphasis on corporate sustainability initiatives is a significant driver of the Commercial Industrial PV Inverter Market. Many companies are adopting sustainability goals as part of their corporate strategies, aiming to enhance their brand image and meet consumer expectations. In 2025, a notable percentage of corporations are expected to commit to renewable energy targets, with many pledging to achieve net-zero emissions by 2030. This commitment often involves investing in solar energy systems, which necessitate the use of efficient PV inverters. As businesses strive to align their operations with sustainability principles, the demand for the Commercial Industrial PV Inverter Market is likely to increase, reflecting a broader shift towards environmentally responsible practices.

Technological Innovations in Inverter Efficiency

Technological innovations in inverter efficiency are driving advancements in the Commercial Industrial PV Inverter Market. The development of high-efficiency inverters, such as those utilizing advanced semiconductor materials, has led to improved energy conversion rates. In 2025, the market is witnessing a trend towards inverters that can achieve efficiencies exceeding 98%, which enhances the overall performance of solar energy systems. These innovations not only reduce energy losses but also lower operational costs for businesses. As industries increasingly recognize the value of high-performance inverters, the demand for such technologies is expected to rise, further propelling the growth of the Commercial Industrial PV Inverter Market.