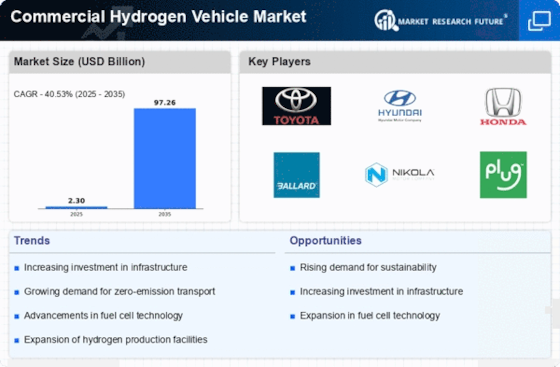

Corporate Sustainability Initiatives

The growing emphasis on corporate sustainability initiatives is influencing the Commercial Hydrogen Vehicle Market. Many companies are adopting hydrogen vehicles as part of their commitment to reducing their carbon footprint. This trend is particularly evident in sectors such as logistics and transportation, where companies are seeking to enhance their sustainability profiles. Data indicates that businesses utilizing hydrogen fuel cell vehicles can achieve substantial reductions in emissions, aligning with their environmental goals. As more corporations prioritize sustainability, the demand for hydrogen vehicles is likely to increase, further driving market growth.

Investment in Hydrogen Infrastructure

The expansion of hydrogen infrastructure is a key driver for the Commercial Hydrogen Vehicle Market. Investments in refueling stations and distribution networks are essential for supporting the growth of hydrogen vehicles. Recent reports suggest that the number of hydrogen refueling stations is projected to increase significantly, with estimates indicating a potential growth of over 200% in the next five years. This infrastructure development is crucial for alleviating range anxiety among consumers and businesses, thereby encouraging the adoption of hydrogen vehicles in various commercial sectors.

Government Support and Regulatory Frameworks

Government policies and regulatory frameworks are instrumental in shaping the Commercial Hydrogen Vehicle Market. Many governments are implementing supportive measures, such as subsidies and tax incentives, to promote the adoption of hydrogen vehicles. Recent initiatives have shown that countries with robust regulatory support for hydrogen technologies are witnessing faster market growth. This governmental backing not only encourages manufacturers to invest in hydrogen vehicle production but also reassures consumers about the viability of hydrogen as a fuel source, potentially leading to increased market penetration.

Rising Demand for Sustainable Transportation

The increasing awareness of climate change and environmental degradation has led to a rising demand for sustainable transportation solutions. The Commercial Hydrogen Vehicle Market is experiencing growth as businesses and consumers seek alternatives to fossil fuel-powered vehicles. This shift is driven by the need to reduce greenhouse gas emissions and improve air quality. According to recent data, hydrogen fuel cell vehicles can reduce emissions by up to 50% compared to traditional vehicles. As more companies commit to sustainability goals, the demand for hydrogen vehicles is expected to rise, potentially leading to a market expansion in the coming years.

Advancements in Hydrogen Production Technologies

Innovations in hydrogen production technologies are playing a crucial role in the Commercial Hydrogen Vehicle Market. The development of more efficient and cost-effective methods for producing hydrogen, such as electrolysis and steam methane reforming, is likely to enhance the availability of hydrogen fuel. Recent advancements indicate that the cost of green hydrogen production could decrease significantly, making it a more viable option for fueling commercial vehicles. This could lead to an increase in the adoption of hydrogen vehicles, as businesses look for reliable and sustainable fuel sources to meet their operational needs.