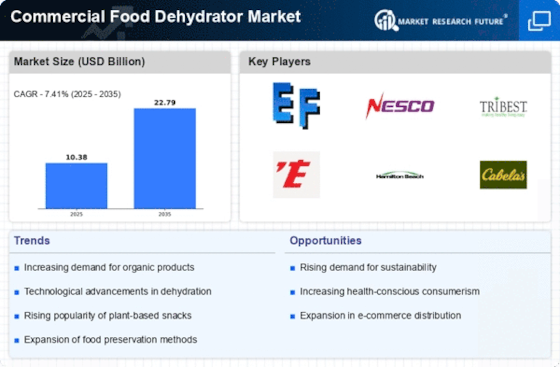

Rising Demand for Healthy Snacks

The increasing consumer inclination towards healthy eating habits is a pivotal driver for the commercial food dehydrator Market. As individuals become more health-conscious, the demand for nutritious snacks has surged. Dehydrated fruits and vegetables are perceived as healthier alternatives to traditional snacks, which often contain preservatives and artificial ingredients. According to recent data, the market for healthy snacks is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This trend is likely to propel the Commercial Food Dehydrator Market, as manufacturers seek to meet the rising demand for natural and wholesome snack options.

Expansion of Food Processing Sector

The expansion of the food processing sector is significantly influencing the Commercial Food Dehydrator Market. As food processing companies strive to enhance product shelf life and reduce waste, the adoption of food dehydrators has become increasingly prevalent. The food processing industry is expected to witness a growth rate of around 6% annually, driven by the need for efficient preservation methods. This growth presents a substantial opportunity for the Commercial Food Dehydrator Market, as businesses invest in advanced dehydration technologies to improve operational efficiency and product quality.

Increasing Popularity of Home Dehydration

The rising trend of home food preservation is emerging as a significant driver for the Commercial Food Dehydrator Market. More consumers are opting to dehydrate their own fruits, vegetables, and meats at home, motivated by the desire for fresh, chemical-free products. This shift is reflected in the growing sales of home dehydrators, which have seen an increase of approximately 15% in recent years. As home cooks become more adventurous and knowledgeable about food preservation techniques, the Commercial Food Dehydrator Market is likely to benefit from this burgeoning interest in home dehydration.

Sustainability and Waste Reduction Efforts

Sustainability initiatives are increasingly influencing consumer choices, thereby impacting the Commercial Food Dehydrator Market. As awareness of food waste grows, more businesses and consumers are seeking methods to reduce waste through effective preservation techniques. Dehydration is recognized as a sustainable method to extend the shelf life of perishable items, aligning with the global push towards sustainability. The market for sustainable food practices is projected to expand, with estimates indicating a growth rate of around 7% annually. This trend suggests that the Commercial Food Dehydrator Market will likely see increased demand as stakeholders prioritize environmentally friendly food preservation solutions.

Adoption of Innovative Dehydration Technologies

Technological advancements in dehydration methods are reshaping the Commercial Food Dehydrator Market. Innovations such as freeze-drying and solar dehydration are gaining traction, offering enhanced efficiency and product quality. These technologies not only preserve the nutritional value of food but also improve the overall taste and texture of dehydrated products. The market for advanced dehydration technologies is anticipated to grow, with estimates suggesting a potential increase of 10% in adoption rates over the next few years. This trend indicates a promising future for the Commercial Food Dehydrator Market, as manufacturers seek to leverage these innovations to meet consumer expectations.