Market Growth Projections

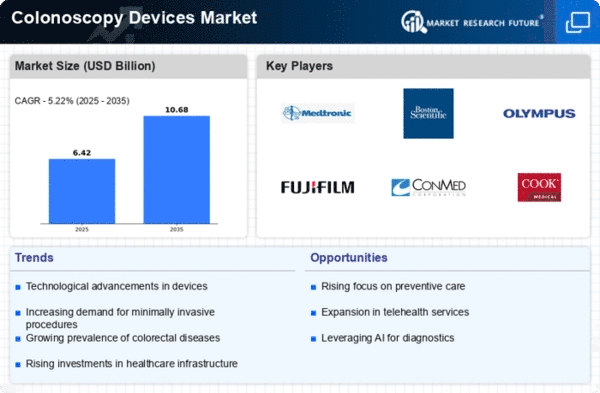

The Global Colonoscopy Devices Market Industry is projected to experience substantial growth over the next decade. With a market value of 6.1 USD Billion in 2024, it is anticipated to reach 10.7 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 5.22% from 2025 to 2035. Factors contributing to this expansion include technological advancements, increasing awareness of colorectal health, and government initiatives promoting screening. The market's evolution reflects a broader trend towards preventive healthcare and the adoption of innovative medical technologies.

Rising Incidence of Colorectal Cancer

The increasing prevalence of colorectal cancer globally serves as a primary driver for the Global Colonoscopy Devices Market Industry. According to health statistics, colorectal cancer remains one of the leading causes of cancer-related deaths worldwide. The World Health Organization indicates that early detection through colonoscopy can significantly improve survival rates. As awareness of this disease rises, more individuals are likely to undergo screening, thereby boosting demand for colonoscopy devices. The market is projected to reach 6.1 USD Billion in 2024, reflecting the urgent need for effective diagnostic tools in combating this prevalent health issue.

Government Initiatives and Screening Programs

Government-led initiatives aimed at increasing colorectal cancer screening rates are pivotal in shaping the Global Colonoscopy Devices Market Industry. Many countries have implemented national screening programs that encourage regular colonoscopies for at-risk populations. These programs often provide funding and resources to facilitate access to screening, thereby increasing the number of procedures performed annually. For instance, the U.S. Preventive Services Task Force recommends routine screening starting at age 45. Such initiatives not only raise awareness but also directly contribute to market growth, as more individuals seek colonoscopy services.

Technological Advancements in Colonoscopy Devices

Innovations in colonoscopy technology are transforming the Global Colonoscopy Devices Market Industry. Enhanced imaging techniques, such as high-definition and narrow-band imaging, improve the accuracy of polyp detection and characterization. Furthermore, the development of robotic-assisted colonoscopy systems offers greater precision and reduces patient discomfort. These advancements not only enhance the effectiveness of procedures but also increase the efficiency of healthcare providers. As a result, the market is expected to grow significantly, with projections indicating a rise to 10.7 USD Billion by 2035, driven by the adoption of these cutting-edge technologies.

Growing Awareness and Education on Colorectal Health

There is a notable increase in public awareness and education regarding colorectal health, which is positively impacting the Global Colonoscopy Devices Market Industry. Campaigns aimed at educating the public about the importance of early detection and regular screenings are gaining traction. Organizations and healthcare providers are actively promoting the benefits of colonoscopy in preventing colorectal cancer. This heightened awareness is likely to lead to an increase in screening rates, thereby driving demand for colonoscopy devices. As more individuals become informed about their health, the market is poised for continued growth.

Aging Population and Increased Healthcare Expenditure

The aging population globally is a significant factor driving the Global Colonoscopy Devices Market Industry. As individuals age, the risk of developing colorectal issues increases, necessitating regular screenings. Additionally, higher healthcare expenditure among older adults allows for more frequent use of advanced medical technologies, including colonoscopy devices. This demographic shift is expected to result in a substantial increase in market demand, with a projected compound annual growth rate (CAGR) of 5.22% from 2025 to 2035. The combination of an aging population and increased healthcare investment creates a robust environment for market expansion.