Emergence of 5G Technology

The Coherent Optical Equipment Market is poised for transformation with the emergence of 5G technology. The rollout of 5G networks necessitates advanced optical solutions to handle the increased data traffic and connectivity demands. Coherent optical equipment plays a pivotal role in enabling the high-speed, low-latency communication that 5G promises. As telecommunications companies invest heavily in 5G infrastructure, the demand for coherent optical technology is expected to rise correspondingly. Analysts predict that the integration of coherent optical systems will be essential for achieving the performance benchmarks set by 5G, thereby driving growth in the coherent optical equipment market.

Increased Investment in Data Centers

The Coherent Optical Equipment Market is benefiting from increased investment in data centers. As businesses continue to migrate to cloud-based solutions, the demand for efficient data center operations has intensified. Coherent optical technology is integral to enhancing data center connectivity and ensuring rapid data transfer between servers. Recent reports suggest that the data center market is expected to reach a valuation of over 200 billion by 2026, with coherent optical equipment being a critical component in achieving the necessary bandwidth and speed. This investment trend underscores the importance of coherent optical solutions in supporting the infrastructure required for modern data management.

Growth in Fiber Optic Network Deployments

The Coherent Optical Equipment Market is significantly influenced by the expansion of fiber optic network deployments. Telecommunications providers are increasingly investing in fiber optic infrastructure to meet the rising demand for high-capacity networks. This trend is further fueled by the need for enhanced connectivity in urban areas and the expansion of 5G networks. As of 2025, it is estimated that fiber optic networks will cover over 80% of urban regions, necessitating advanced coherent optical solutions to optimize performance. The integration of coherent optical equipment into these networks is crucial for maximizing data throughput and minimizing latency, thereby supporting the overall growth of the telecommunications sector.

Adoption of Advanced Communication Protocols

The Coherent Optical Equipment Market is witnessing a shift towards the adoption of advanced communication protocols. As industries evolve, there is a growing need for more efficient and reliable communication methods. Coherent optical technology supports various advanced protocols, enabling higher data rates and improved signal integrity. This trend is particularly relevant in sectors such as finance, healthcare, and education, where data transmission reliability is paramount. The increasing adoption of these protocols is likely to drive demand for coherent optical equipment, as organizations seek to enhance their communication capabilities and ensure seamless data flow across their networks.

Rising Demand for High-Speed Data Transmission

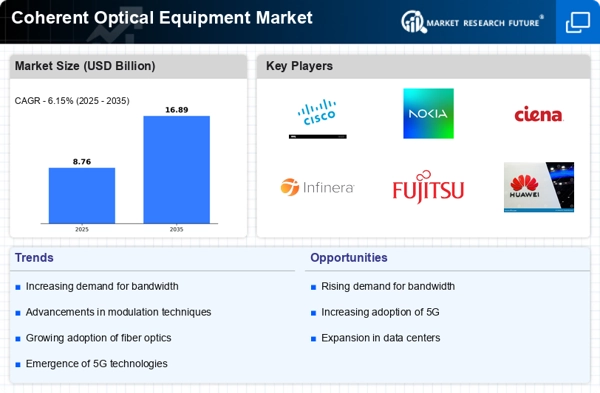

The Coherent Optical Equipment Market is experiencing a notable surge in demand for high-speed data transmission. This demand is primarily driven by the increasing reliance on cloud computing, streaming services, and data-intensive applications. As organizations seek to enhance their network capabilities, coherent optical technology offers the necessary bandwidth and speed. Recent data indicates that the market for coherent optical equipment is projected to grow at a compound annual growth rate of approximately 12% over the next five years. This growth is indicative of the industry's response to the escalating need for efficient data transfer solutions, which are essential for supporting the burgeoning digital economy.