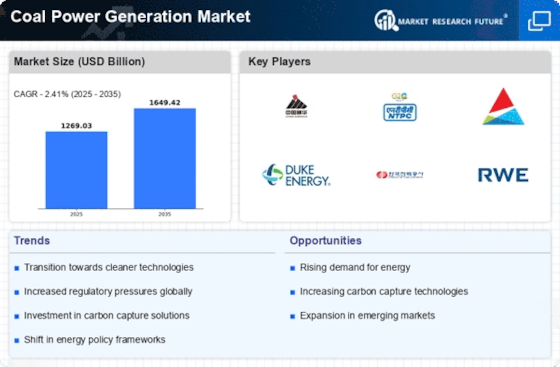

The Coal Power Generation Market is expected to continue growing steadily over the next decade, driven by increasing demand for electricity in developing countries and the relatively low cost of coal compared to other fossil fuels. However, the market is facing challenges from growing environmental concerns and the increasing adoption of renewable energy sources. In 2023, the Coal Power Generation Market was valued at USD 1209.94 billion and is projected to reach USD 1500.0 billion by 2032, exhibiting a CAGR of 2.41% during the forecast period.

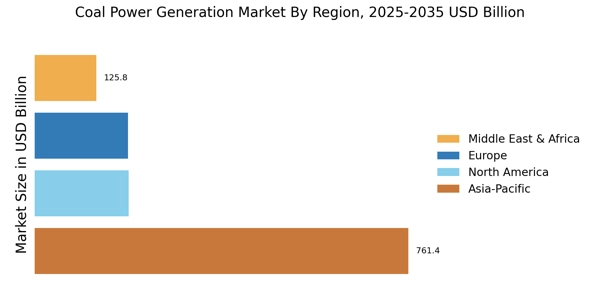

Asia-Pacific is the largest regional market, accounting for over 60% of the global market share.

China is the largest market in the region, followed by India and Japan. Some of the key recent developments in the Coal Power Generation Market include:- In January 2023, the Chinese government announced plans to increase coal production capacity by 300 million tons per year to meet the growing demand for electricity.- In March 2023, the Indian government announced plans to invest USD 10 billion in the development of new coal-fired power plants.- In April 2023, the European Union announced plans to phase out coal-fired power plants by 2030.

These developments are expected to have a significant impact on the Coal Power Generation Market over the next decade.

In July 2024, NTPC commissioned a unit of 660 MW at its Barh Super Thermal Power Station, situated in Bihar. The integration of this additional unit will assist India in the ability to balance energy security and energy transition.

In December 2024, Eskom revealed strategies to retire a number of coal-fired plants by 2025 while at the same time intending to maintain electricity reliability with low-cost coal during the transition to renewable sources from coal in accordance with their decarbonized active plan of $10 billion.

In August 2024, China approved 6.66 gw of new coal capacity, down from previous targets of 40gw in March; this change falls in line with China's renewable energy targets; however, on the contrary, 41 gw of coal commenced construction in 2024, this indicates that matter is still complicated with various coal builds being materialized alongside the environmental implications that follow.

In June 2024, RWE announced that they would temporarily restart and reactivate a number of coal-generated units in order to provide energy resources in points of geopolitical disagreement but at the same time asserted their policy to retire coal-burning units by 2030.

In May 2024, PGE fast-tracked the construction of a new Turów coal power unit; this is expected to come online between late 2024 to early 2025, which is completely against coal phaseout trends by the whole of the EU.

In April 2024, Southern Company announced intentions to retrofit its coal plants with carbon capture technology with the aim of decreasing emissions while continuing coal-powered plants supply baseload power.

In October 2024, Origin Energy released a bond confirming that its Eraring coal plant would be shut down completely by 2025 as they are interested in expanding their renewable energy, and coal seems to be a lot less competitive.

In January 2024, Bharat Heavy Electricals Limited (BHEL) and NTPC agreed to join together for the advancement of AUSC technology, which is aimed at enhancing the performance of coal power plants and cutting down emissions in the Indian energy market. The aim of the technology is to achieve better thermal efficiencies than the older plants.