Growing Focus on Personalized Medicine

The increasing emphasis on personalized medicine is a notable driver for the Coagulation Analyzer Market. As healthcare shifts towards tailored treatment approaches, the demand for precise diagnostic tools that can provide individualized patient data is rising. Coagulation analyzers play a crucial role in this paradigm by enabling healthcare providers to assess patients' coagulation profiles accurately. This capability is essential for developing personalized treatment plans, particularly for patients with complex coagulation disorders. The market is witnessing a surge in the development of analyzers that can integrate genetic and biomarker data, further enhancing their utility in personalized medicine. As this trend continues, the Coagulation Analyzer Market is likely to expand, driven by the need for advanced diagnostic solutions that support individualized patient care.

Rising Incidence of Coagulation Disorders

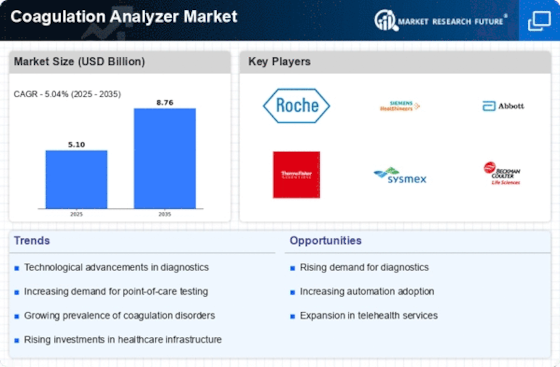

The increasing prevalence of coagulation disorders, such as hemophilia and thrombosis, is a primary driver for the Coagulation Analyzer Market. According to recent data, the incidence of these disorders is on the rise, leading to a heightened demand for accurate diagnostic tools. This trend is further supported by the growing awareness of the importance of early diagnosis and management of coagulation-related conditions. As healthcare providers seek to improve patient outcomes, the need for advanced coagulation analyzers becomes more pronounced. The market is projected to witness substantial growth, with estimates suggesting a compound annual growth rate (CAGR) of over 6% in the coming years. This growth is indicative of the increasing reliance on sophisticated diagnostic equipment in clinical settings.

Increasing Demand for Point-of-Care Testing

The shift towards point-of-care testing (POCT) is reshaping the Coagulation Analyzer Market. Healthcare providers are increasingly favoring POCT due to its ability to deliver rapid results at the patient's bedside, thereby facilitating immediate clinical decisions. This trend is particularly relevant in emergency care settings, where timely diagnosis is critical. The convenience and efficiency of POCT are driving its adoption across various healthcare facilities, including hospitals and outpatient clinics. Market data indicates that the segment for point-of-care coagulation analyzers is expected to grow significantly, with projections estimating a CAGR of around 8% over the next few years. This growth reflects the ongoing transformation in healthcare delivery models, emphasizing the need for accessible and efficient diagnostic solutions.

Technological Innovations in Diagnostic Equipment

Technological advancements in diagnostic equipment are significantly influencing the Coagulation Analyzer Market. Innovations such as automated analyzers, point-of-care testing devices, and integrated software solutions are enhancing the efficiency and accuracy of coagulation testing. These advancements not only streamline laboratory workflows but also reduce the turnaround time for test results, which is crucial for timely patient management. The market is experiencing a shift towards more sophisticated analyzers that offer multi-parameter testing capabilities, thereby catering to a broader range of clinical needs. As healthcare facilities increasingly adopt these technologies, the demand for modern coagulation analyzers is expected to rise, contributing to a robust market growth trajectory.

Regulatory Support and Standardization Initiatives

Regulatory support and standardization initiatives are fostering growth in the Coagulation Analyzer Market. Governments and health organizations are increasingly recognizing the importance of standardized testing protocols to ensure the accuracy and reliability of coagulation tests. This recognition is leading to the establishment of guidelines and regulations that promote the adoption of advanced coagulation analyzers in clinical laboratories. Furthermore, initiatives aimed at improving laboratory practices and enhancing quality control measures are likely to drive demand for state-of-the-art analyzers. As regulatory bodies continue to emphasize the need for high-quality diagnostic tools, the market is expected to benefit from increased investments in research and development, ultimately leading to the introduction of innovative coagulation analyzers that meet stringent regulatory standards.