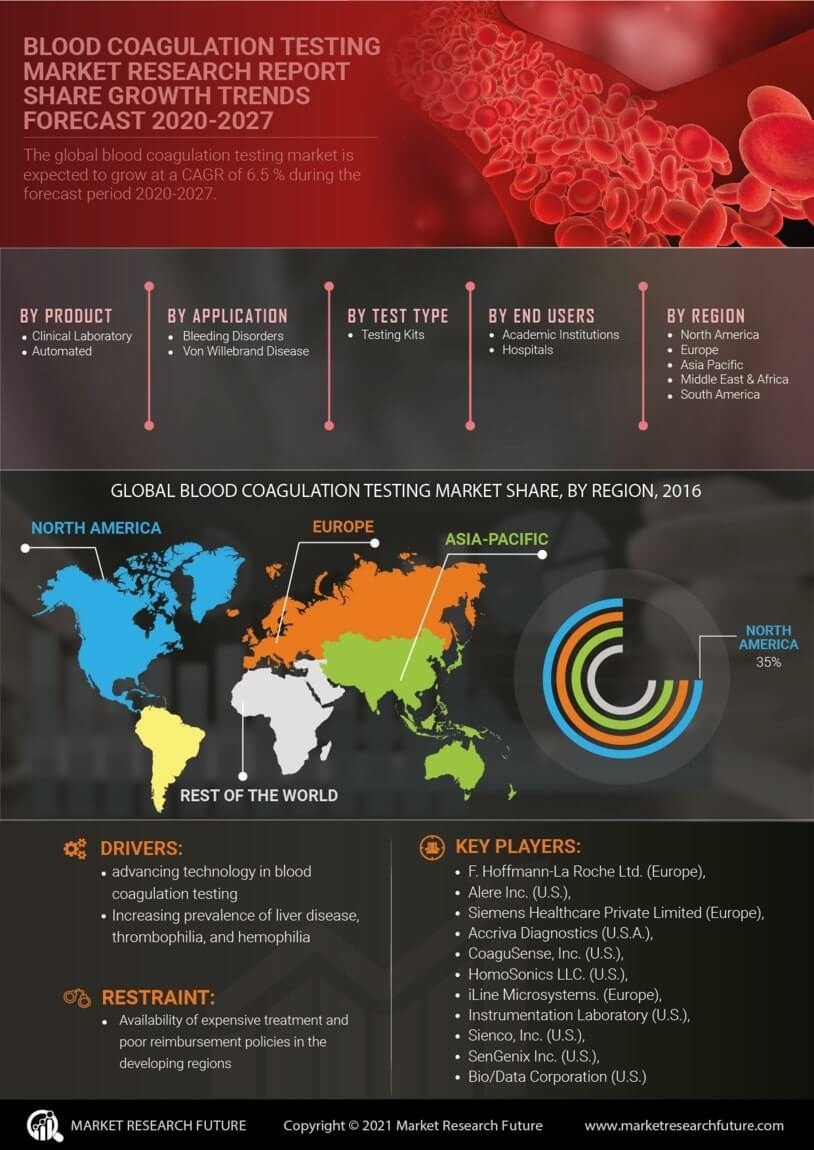

North America : Market Leader in Innovation

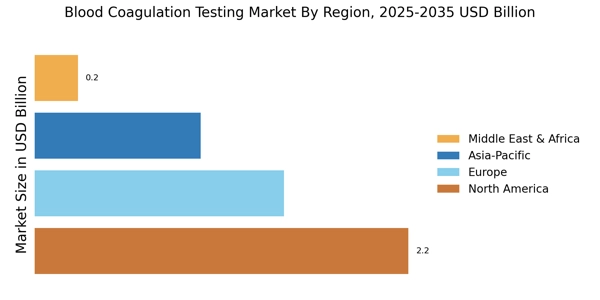

North America is the largest market for blood coagulation testing, holding approximately 45% of the global share. The region benefits from advanced healthcare infrastructure, high prevalence of coagulation disorders, and significant investments in R&D.

Regulatory support from agencies like the FDA further drives innovation and adoption of new technologies, enhancing market growth. The increasing demand for point-of-care testing and home healthcare solutions is also a key driver of market expansion.

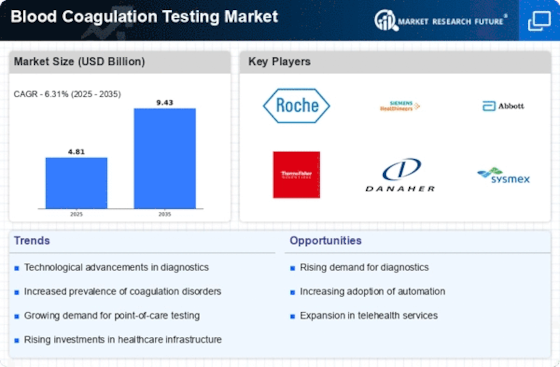

The United States is the leading country in this region, with major players like Abbott Laboratories and Thermo Fisher Scientific dominating the market.

Canada follows as the second-largest market, contributing to the overall growth with its expanding healthcare sector. The competitive landscape is characterized by continuous innovation and strategic partnerships among key players, ensuring a robust supply of advanced coagulation testing solutions.

Europe : Emerging Regulatory Frameworks

Europe is the second-largest market for blood coagulation testing, accounting for approximately 30% of the global market share. The region is witnessing growth driven by increasing awareness of coagulation disorders and the implementation of stringent regulatory frameworks.

The European Medicines Agency (EMA) plays a crucial role in ensuring the safety and efficacy of medical devices, which fosters innovation and market entry for new products. The rising demand for personalized medicine and advanced diagnostic tools is also propelling market growth.

Germany and France are the leading countries in this market, with a strong presence of key players such as Siemens Healthineers and Roche Diagnostics. The competitive landscape is marked by collaborations between manufacturers and healthcare providers to enhance product offerings.

Additionally, the presence of a well-established healthcare system supports the adoption of advanced coagulation testing technologies, ensuring sustained market growth.

Asia-Pacific : Rapidly Growing Healthcare Sector

Asia-Pacific is an emerging powerhouse in the blood coagulation testing market, holding approximately 20% of the global share. The region is experiencing rapid growth due to increasing healthcare expenditures, rising awareness of coagulation disorders, and a growing aging population.

Countries like China and India are investing heavily in healthcare infrastructure, which is expected to drive demand for advanced diagnostic solutions. Regulatory bodies are also becoming more supportive, facilitating market entry for innovative products.

China is the largest market in this region, followed by Japan and India. The competitive landscape is evolving, with both local and international players vying for market share.

Key players such as Sysmex Corporation and Grifols S.A. are expanding their presence through strategic partnerships and collaborations. The increasing focus on point-of-care testing and home healthcare solutions is further enhancing the market dynamics in this region.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region represents a smaller segment of the blood coagulation testing market, accounting for approximately 5% of the global share. However, it is witnessing growth driven by increasing healthcare investments and rising awareness of coagulation disorders.

Governments are focusing on improving healthcare infrastructure, which is expected to enhance access to diagnostic services. The region's diverse healthcare needs present unique opportunities for market players to introduce innovative solutions tailored to local requirements.

South Africa and the UAE are the leading countries in this market, with a growing presence of international players. The competitive landscape is characterized by a mix of local and global companies, with key players like Hemosure Inc. making strides in the market.

The increasing prevalence of chronic diseases and the need for effective diagnostic tools are expected to drive future growth in this region.