Market Growth Projections

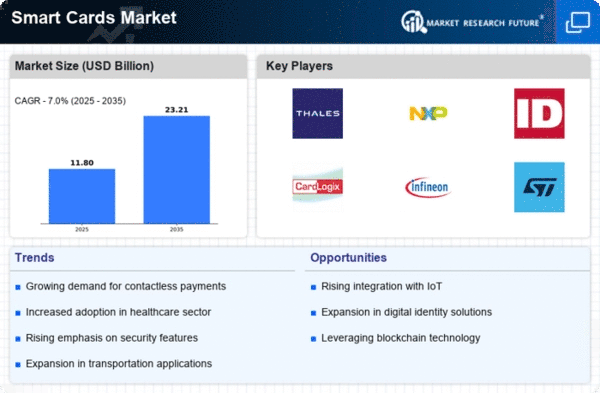

The Global Smart Cards Market Industry is poised for substantial growth, with projections indicating a market size of 11.0 USD Billion in 2024 and an anticipated increase to 23.2 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 7.0% from 2025 to 2035. The market dynamics are influenced by various factors, including technological advancements, increasing demand for secure transactions, and government initiatives promoting digitalization. These projections highlight the potential for innovation and investment in smart card technology, making it a critical area of focus for stakeholders in the industry.

Enhanced Security Features

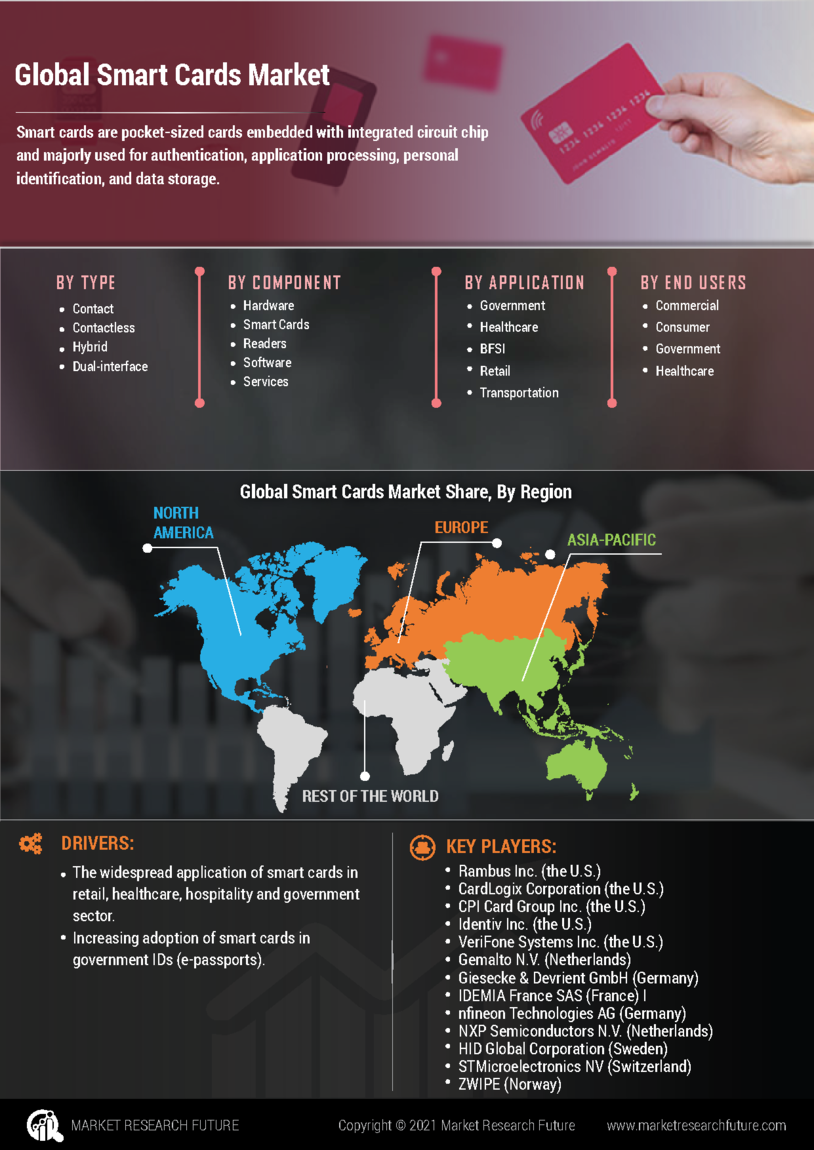

The need for enhanced security in financial transactions and personal identification is a significant driver for the Global Smart Cards Market Industry. Smart cards offer advanced encryption and authentication mechanisms, making them a preferred choice for secure transactions. Governments and organizations are increasingly adopting smart cards for identity verification and access control. For instance, many countries are implementing smart ID cards to combat fraud and enhance national security. This focus on security is expected to contribute to the market's growth, as consumers and businesses prioritize safety in their transactions.

Rising Adoption in Emerging Markets

The rising adoption of smart card technology in emerging markets is a crucial driver for the Global Smart Cards Market Industry. Countries in Asia-Pacific, Latin America, and Africa are increasingly recognizing the benefits of smart cards for financial inclusion and secure identification. As mobile penetration increases and digital payment ecosystems develop, the demand for smart cards is expected to surge. This trend is particularly evident in regions where traditional banking infrastructure is limited. The growth in these markets presents significant opportunities for smart card manufacturers and service providers, contributing to the overall expansion of the industry.

Government Initiatives and Regulations

Government initiatives aimed at promoting digitalization and secure transactions are pivotal in driving the Global Smart Cards Market Industry. Various countries are implementing regulations that encourage the adoption of smart card technology in sectors such as healthcare, transportation, and finance. For example, initiatives to replace traditional identification methods with smart cards are gaining momentum globally. These efforts not only enhance security but also improve efficiency in service delivery. As governments continue to invest in smart card infrastructure, the market is anticipated to expand, with projections indicating a growth to 23.2 USD Billion by 2035.

Growing Demand for Contactless Payments

The increasing preference for contactless payment solutions is a primary driver of the Global Smart Cards Market Industry. As consumers seek convenience and speed in transactions, smart cards equipped with Near Field Communication (NFC) technology are gaining traction. In 2024, the market is projected to reach 11.0 USD Billion, reflecting a substantial shift towards digital payment methods. Retailers and financial institutions are investing in smart card technology to enhance customer experience and streamline payment processes. This trend is likely to continue, as the demand for secure and efficient payment solutions grows, further propelling the market forward.

Technological Advancements in Smart Card Solutions

Technological advancements in smart card solutions are significantly influencing the Global Smart Cards Market Industry. Innovations such as biometric authentication, multi-application capabilities, and integration with mobile devices are enhancing the functionality of smart cards. These advancements are appealing to various sectors, including banking, healthcare, and transportation, where secure and versatile solutions are essential. As organizations seek to leverage these technologies, the market is likely to experience robust growth. The anticipated compound annual growth rate (CAGR) of 7.0% from 2025 to 2035 underscores the potential for continued innovation and expansion in this sector.