Rising Adoption in Various Industries

The US Smart Cards Market is experiencing a surge in adoption across various industries, including healthcare, transportation, and retail. In healthcare, smart cards are being utilized for patient identification and electronic health records, enhancing the efficiency of medical services. Similarly, in the transportation sector, smart cards are increasingly used for fare collection and access control, streamlining operations and improving user experience. Recent data suggests that the healthcare segment alone is expected to grow at a CAGR of 12% through 2026, indicating a robust demand for smart card solutions. This widespread adoption across diverse sectors not only reinforces the relevance of the US Smart Cards Market but also highlights its potential for future expansion.

Government Regulations and Initiatives

The US Smart Cards Market is significantly influenced by government regulations and initiatives aimed at enhancing security and efficiency in various sectors. The implementation of the REAL ID Act, which mandates the use of secure identification for federal purposes, has spurred the adoption of smart cards in government agencies and transportation sectors. Additionally, initiatives promoting digital identity verification are likely to drive further growth in the smart card market. As federal and state governments invest in upgrading their identification systems, the demand for smart cards is expected to rise. This regulatory landscape not only fosters innovation but also positions the US Smart Cards Market as a critical component in the broader context of national security and public safety.

Growing Demand for Secure Transactions

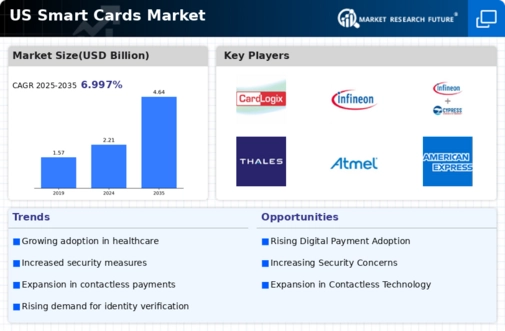

The US Smart Cards Market is experiencing a notable increase in demand for secure transaction methods. As cyber threats continue to evolve, businesses and consumers alike are seeking more reliable payment solutions. Smart cards, equipped with advanced encryption and authentication features, provide a robust defense against fraud. According to recent data, the market for smart cards in the US is projected to reach approximately USD 10 billion by 2026, driven by the need for enhanced security in financial transactions. This trend is particularly evident in sectors such as banking and retail, where the adoption of smart cards is becoming a standard practice to safeguard sensitive information. The growing emphasis on security is likely to propel the US Smart Cards Market further, as organizations prioritize the protection of their customers' data.

Expansion of Contactless Payment Solutions

The US Smart Cards Market is witnessing a significant shift towards contactless payment solutions. With the increasing prevalence of mobile wallets and NFC technology, consumers are gravitating towards smart cards that facilitate quick and convenient transactions. Recent statistics indicate that contactless payments accounted for over 30% of all card transactions in the US in 2025, highlighting a growing preference for speed and efficiency. This trend is further supported by the ongoing development of infrastructure that accommodates contactless technology, such as point-of-sale systems. As more retailers and service providers adopt these solutions, the demand for smart cards is expected to surge, reinforcing the position of the US Smart Cards Market as a leader in innovative payment methods.

Technological Advancements in Smart Card Features

The US Smart Cards Market is benefiting from rapid technological advancements that enhance the functionality and appeal of smart cards. Innovations such as biometric authentication, embedded chips, and multi-application capabilities are transforming the landscape of smart card usage. For instance, biometric smart cards that incorporate fingerprint recognition are gaining traction in sectors requiring high security, such as healthcare and finance. The integration of these advanced features is likely to attract a broader consumer base, as users seek cards that offer both convenience and security. As technology continues to evolve, the US Smart Cards Market is poised for growth, with manufacturers investing in research and development to create next-generation smart card solutions.