Cnc Machine Size

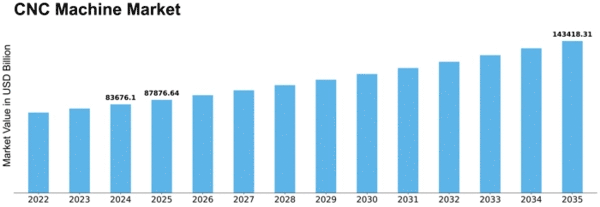

CNC Machine Market Growth Projections and Opportunities

The CNC (Computer Numerical Control) machine market is influenced by a multitude of market factors that collectively shape its landscape. One of the primary drivers of this market is the increasing demand for precision machining across various industries. CNC machines, equipped with advanced automation and control systems, offer unparalleled accuracy and efficiency in manufacturing processes. As industries such as aerospace, automotive, and healthcare emphasize precision in component production, the demand for CNC machines has seen a significant uptick.

Technological advancements play a pivotal role in the CNC machine market. Continuous innovation in machine tool design, control systems, and cutting technologies enhances the performance and capabilities of CNC machines. Manufacturers are continually striving to introduce features such as multi-axis machining, real-time monitoring, and artificial intelligence integration to stay competitive in the market. These technological enhancements not only improve efficiency but also contribute to the overall growth of the CNC machine market.

The global trend toward Industry 4.0, characterized by the integration of smart technologies and the Internet of Things (IoT) in manufacturing, has a profound impact on the CNC machine market. Smart CNC machines that can communicate, analyze data, and optimize processes are becoming increasingly popular. This shift towards intelligent manufacturing is driven by the need for real-time decision-making, predictive maintenance, and the overall optimization of production workflows.

Market dynamics are also influenced by the diverse applications of CNC machines. While traditionally associated with metal cutting and shaping, CNC machines are now used in various materials, including plastics, composites, and even 3D printing. The versatility of CNC machines makes them indispensable in a wide range of industries, contributing to their sustained demand and market growth.

Government regulations and policies play a crucial role in shaping the CNC machine market. Regulatory compliance, safety standards, and environmental regulations influence the design and manufacturing processes of CNC machines. Additionally, government initiatives to promote local manufacturing, provide incentives for technological adoption, or invest in vocational training programs for skilled machine operators contribute to the market's dynamics.

The competitive landscape within the CNC machine market is characterized by the presence of global leaders, regional players, and niche specialists. Collaborations, partnerships, and strategic alliances are common strategies employed by companies to enhance their technological capabilities and expand their market reach. Continuous research and development efforts are essential for companies to stay ahead in this competitive market, meeting the evolving demands of diverse industries.

Economic factors such as GDP growth, industrial production, and investment in infrastructure projects significantly impact the CNC machine market. Economic downturns may lead to a slowdown in capital expenditures and a delay in the adoption of advanced manufacturing technologies. Conversely, periods of economic growth often result in increased investment in modernizing manufacturing facilities, driving demand for CNC machines.

Aftermarket services also contribute to the market dynamics of CNC machines. Maintenance, repair, and technical support services are crucial for ensuring the longevity and optimal performance of CNC machines. The availability of spare parts, timely servicing, and efficient customer support are key considerations for businesses when choosing CNC machine suppliers.

the CNC machine market is influenced by a complex interplay of factors, including the demand for precision machining, technological advancements, the shift towards Industry 4.0, diverse applications, government regulations, competition, economic conditions, and aftermarket services. As industries continue to evolve and demand higher levels of efficiency and precision, the CNC machine market is expected to adapt and innovate to meet the challenges and opportunities presented by these market factors.

Leave a Comment