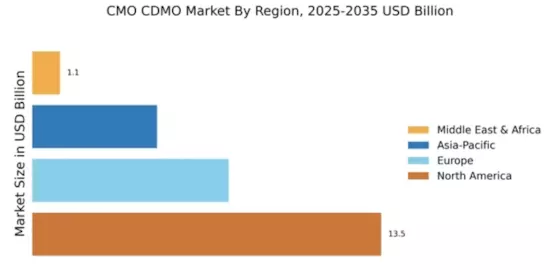

North America : Market Leader in CMO CDMO

North America continues to lead the CMO CDMO market, holding a significant share of 13.54 in 2024. The region's growth is driven by robust demand for biopharmaceuticals, advancements in manufacturing technologies, and supportive regulatory frameworks. The increasing focus on outsourcing production to enhance efficiency and reduce costs further propels market expansion. Regulatory bodies are actively promoting innovation, which is crucial for maintaining competitive advantages in this dynamic sector. The competitive landscape in North America is characterized by the presence of major players such as Lonza, Catalent, and Boehringer Ingelheim. These companies are investing heavily in R&D and expanding their facilities to meet the growing demand. The U.S. remains a key player, supported by a strong infrastructure and a favorable business environment. The market is expected to continue its upward trajectory as companies leverage technological advancements and strategic partnerships to enhance their service offerings.

Europe : Emerging Hub for Biotech

Europe's CMO CDMO market is witnessing significant growth, with a market size of 7.62 in 2024. The region benefits from a strong regulatory framework that encourages innovation and investment in biopharmaceutical manufacturing. Increasing demand for personalized medicine and biologics is driving the need for contract manufacturing services. Additionally, government initiatives aimed at fostering collaboration between academia and industry are catalyzing market growth, making Europe a vital player in the global landscape. Leading countries such as Germany, France, and the UK are at the forefront of this growth, hosting numerous key players like Boehringer Ingelheim and Recipharm. The competitive landscape is marked by strategic partnerships and mergers, enhancing capabilities and service offerings. The European market is characterized by a diverse range of services, from drug development to commercial manufacturing, positioning it as a critical hub for CMO CDMO activities.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is emerging as a rapidly growing market for CMO CDMO services, with a market size of 4.84 in 2024. This growth is fueled by increasing investments in biopharmaceutical manufacturing, a rising demand for generic drugs, and favorable government policies promoting the biotech sector. The region's diverse population and expanding healthcare needs are driving the demand for contract manufacturing services, making it a focal point for global players looking to expand their footprint. Countries like China, Japan, and South Korea are leading the charge, with significant contributions from companies such as WuXi AppTec and Fujifilm Diosynth Biotechnologies. The competitive landscape is evolving, with local firms increasingly collaborating with international players to enhance capabilities. As the region continues to develop its infrastructure and regulatory frameworks, it is poised for sustained growth in the CMO CDMO market.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region is gradually emerging in the CMO CDMO market, with a market size of 1.08 in 2024. The growth is driven by increasing healthcare investments, a rising demand for pharmaceuticals, and government initiatives aimed at enhancing local manufacturing capabilities. The region's diverse economic landscape presents unique opportunities for contract manufacturing services, particularly in the biopharmaceutical sector, as countries seek to reduce dependency on imports and build local expertise. Key players are beginning to establish a presence in the region, with countries like South Africa and the UAE leading the way. The competitive landscape is still developing, but there is a growing interest from international firms looking to tap into the potential of the MEA market. As regulatory frameworks improve and infrastructure develops, the region is expected to attract more investments and partnerships in the CMO CDMO space.