Emphasis on Enhanced Data Security

The Clustering Software Market is also influenced by the growing emphasis on enhanced data security measures. As data breaches and cyber threats become more prevalent, organizations are prioritizing the protection of sensitive information. Clustering software can play a vital role in identifying anomalies and potential security threats within datasets. By effectively clustering data, businesses can enhance their security protocols and mitigate risks. The Clustering Software Market is projected to exceed 300 billion dollars by 2025, suggesting a strong correlation with the Clustering Software Market as organizations seek integrated solutions for data security.

Growing Adoption of Cloud Computing

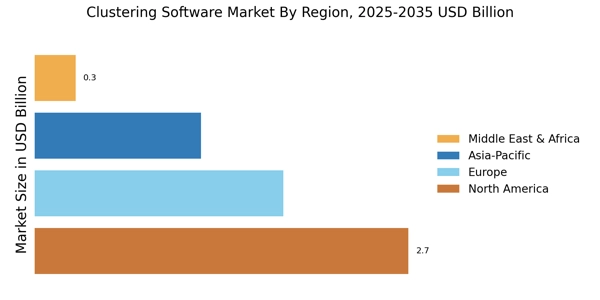

The Clustering Software Market is benefiting from the growing adoption of cloud computing technologies. As more organizations migrate their operations to the cloud, the demand for scalable and flexible clustering solutions increases. Cloud-based clustering software offers businesses the ability to analyze large datasets without the need for extensive on-premises infrastructure. This shift not only reduces costs but also enhances accessibility and collaboration among teams. The cloud computing market is anticipated to reach a valuation of over 800 billion dollars by 2025, indicating a robust environment for the Clustering Software Market to thrive.

Increasing Volume of Data Generation

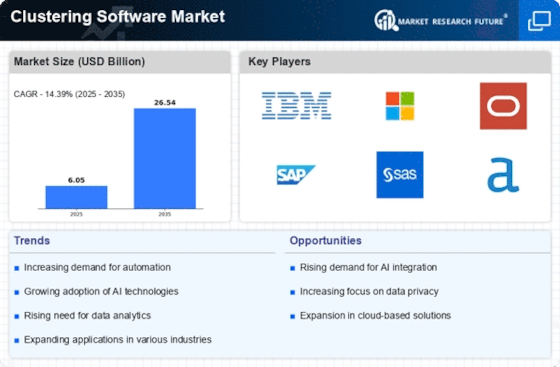

The Clustering Software Market is experiencing a surge in demand due to the exponential growth in data generation across various sectors. As organizations collect vast amounts of data from diverse sources, the need for effective data analysis tools becomes paramount. Clustering software enables businesses to categorize and analyze this data efficiently, facilitating better decision-making. According to recent estimates, the volume of data generated worldwide is expected to reach 175 zettabytes by 2025. This trend indicates a pressing need for clustering solutions that can handle large datasets, thereby driving the growth of the Clustering Software Market.

Rising Need for Real-Time Data Processing

The Clustering Software Market is driven by the rising need for real-time data processing capabilities. In an era where timely insights are critical for competitive advantage, organizations are increasingly seeking clustering solutions that can process and analyze data in real-time. This demand is particularly evident in sectors such as finance, healthcare, and e-commerce, where rapid decision-making is essential. The ability to cluster data in real-time allows businesses to respond swiftly to market changes and customer needs. As a result, the Clustering Software Market is likely to see substantial growth as companies prioritize real-time analytics.

Advancements in Machine Learning Algorithms

The Clustering Software Market is significantly influenced by advancements in machine learning algorithms. These innovations enhance the capabilities of clustering software, allowing for more accurate and efficient data segmentation. As organizations increasingly adopt machine learning techniques, the demand for sophisticated clustering tools rises. The integration of advanced algorithms enables businesses to uncover hidden patterns and insights within their data, which is crucial for strategic planning. The market for machine learning software is projected to grow at a compound annual growth rate of over 40% in the coming years, further propelling the Clustering Software Market.