Market Trends

Key Emerging Trends in the Cloud Analytics Market

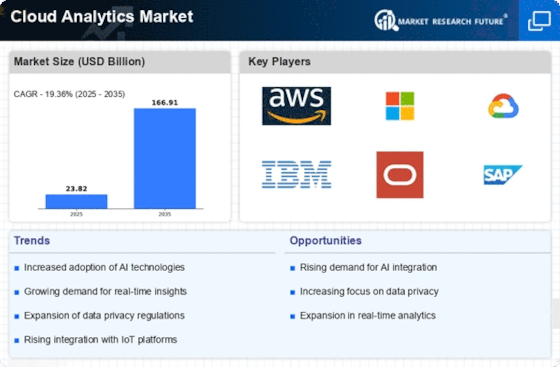

The cloud investigation market is presently going through a dynamic and unique phase characterized by notable trends that are shaping the landscape of data analysis and business intelligence. One such prominent trend driving this market is the increasing adoption of cloud-based solutions across industries. Organizations are more and more recognizing the advantages of shifting their analytics operations to the cloud since it provides flexibility, scalability, and cost-effectiveness. Again, there is an observable surge in demand for advanced analytics tools and technologies. Companies do not just need basic reporting capabilities; they require sophisticated analytics solutions that will offer deeper insights and support data-driven decision-making. Accordingly, cloud analytics vendors are focusing on developing more advanced features like predictive analytics, machine learning (ML), and artificial intelligence (AI), among others, so as to meet their customer's changing needs. Additionally, emphasis on real-time analytics has become another key trend in the cloud analytics industry. A rapid business environment requires organizations to make fast decisions. Furthermore, business intelligence (BI), as well as analytical tools integration with other enterprise applications, is making some progress forward. The seamless embedding of analytics in existing business workflows enables end-users accessibility and ease of use, thus breaking down these silos thereby leading to a unified view of data across various departments. Security and compliance are also becoming increasingly crucial factors influencing the Cloud Analytics market. Whenever companies share sensitive information through cloud platforms, it becomes important to ensure security and compliance with these offerings. Vendors are investing significantly in enhancing security features, deploying strong encryption, and meeting stringent regulatory requirements aimed at building confidence in customers. Data and analytics democratization is a significant trend, too. Cloud analytic solutions are becoming more user-friendly, allowing individuals from different departments to tap into data power without needing technical expertise. A wider number of users can now get insights due to this democratization, which leads to more information-driven corporate cultures within firms.

Leave a Comment