Market Analysis

In-depth Analysis of Cloud Analytics Market Industry Landscape

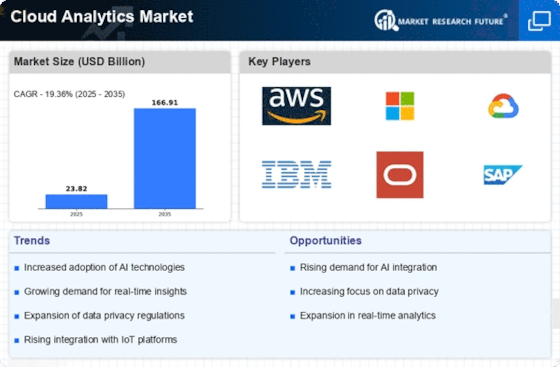

The changing landscape of information management and business intelligence is driving dynamic shifts in the Cloud Analytics market. The demand for cloud-based analytics solutions has surged as organizations become increasingly aware of how important data-driven insights are for informed decision-making. One such driver is the growing adoption of cloud infrastructure, which offers flexible scalability along with affordable pricing models that are highly flexible (Mehrabi et al., 2021). Another key driver for this dynamic growth trend is the big data explosion, where businesses are desperate for next-generation analytics tools capable of processing vast datasets quickly enough to extract valuable insights from them (Gupta et al., 2021). To conduct big data analysis requiring significant computational power as well as storage capabilities, most businesses find themselves relying on cloud-based analytics solutions that enable them to reveal meaningful patterns, trends, or associations hidden within their information. Moreover, the competitive landscape of the Cloud Analytics market is characterized by rising innovations such as artificial intelligence (AI) and machine learning. These technologies boost the analytical capabilities of cloud solutions, enabling predictive and prescriptive analytics. The drive for real-time analytics also shapes the Cloud Analytics market. In today's fast-paced business environment, organizations require instant insights to respond quickly to shifting market conditions and consumer behaviors. By offering real-time data processing capabilities, cloud analytics platforms help businesses make data-driven decisions on the fly and remain agile in an ever-changing landscape. Additionally, security and data privacy concerns play a crucial role in the dynamics of the Cloud Analytics marketplace. Ensuring robust security measures and compliance with regulations become paramount when companies share confidential information via cloud-based platforms. Additionally, the democratization of analytics influences the dynamics of this market as firms aim to make data-driven insights available to a wider range of customers (Li et al., 2021). With easy-to-use interfaces, intuitive dashboards, and self-service analytic capabilities, cloud analytical tools permit non-technical users to conduct their explorations on data without much IT support. This trend encourages decision-making based on empirical evidence throughout organizations, thereby promoting better self-guidance at each organizational level.

Leave a Comment