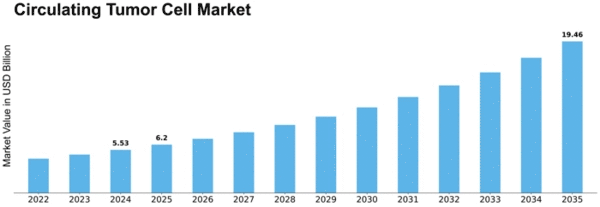

Circulating Tumor Cell Size

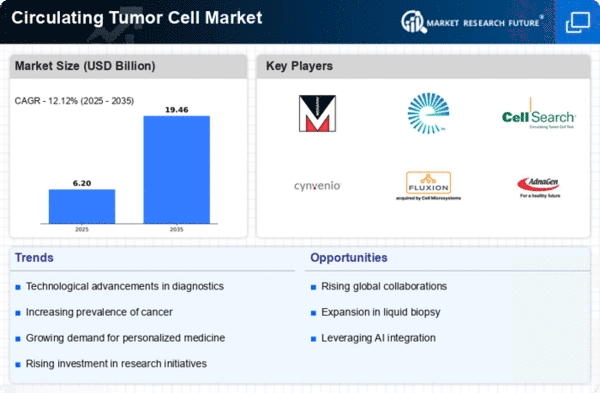

Circulating Tumor Cell Market Growth Projections and Opportunities

The Circulating Tumor Cell (CTC) market has emerged as a dynamic and transformative sector in the field of cancer diagnostics and treatment. The market research report provides a comprehensive analysis of the market size, trends, and factors influencing the growth trajectory of the Circulating Tumor Cell market.

The global Circulating Tumor Cell market has experienced significant expansion, driven by advancements in cancer research, diagnostic technologies, and a growing emphasis on personalized medicine. The market size is a reflection of the increasing recognition of the clinical utility of CTCs in monitoring disease progression, predicting treatment responses, and aiding in the development of targeted therapies.

One of the key drivers of the market size is the rising incidence of cancer worldwide. With cancer being a leading cause of morbidity and mortality, the demand for advanced diagnostic tools that provide real-time information about cancer status is on the rise. CTCs, as tumor cells that have detached from the primary tumor and circulate in the bloodstream, offer a unique and non-invasive method for monitoring cancer dynamics.

The market size is also influenced by the increasing adoption of liquid biopsy techniques. Liquid biopsies, which involve the analysis of CTCs and cell-free DNA (cfDNA) from blood samples, provide a minimally invasive alternative to traditional tissue biopsies. As liquid biopsies gain prominence in cancer diagnostics, the demand for CTC analysis is expected to surge, contributing to the overall market growth.

Technological advancements play a crucial role in shaping the market size of Circulating Tumor Cells. With continuous innovation in CTC isolation and detection technologies, the sensitivity and specificity of CTC assays have improved significantly. These advancements enhance the reliability of CTC-based diagnostics and contribute to the market's expansion.

The market size is further bolstered by the increasing focus on precision medicine and the development of targeted therapies. CTCs serve as a valuable tool in identifying specific genetic mutations and biomarkers, aiding in the personalization of cancer treatment plans. As the field of oncology evolves towards more targeted and individualized approaches, the relevance of CTCs in guiding treatment decisions continues to grow.

Geographically, the market size varies, with North America and Europe being prominent regions due to their robust healthcare infrastructures, extensive research activities, and early adoption of advanced medical technologies. However, the market is witnessing significant growth in Asia-Pacific and other regions, driven by the increasing prevalence of cancer and rising investments in healthcare infrastructure.

In conclusion, the Circulating Tumor Cell market is expanding steadily, driven by the growing global burden of cancer, advancements in diagnostic technologies, and the shift towards personalized medicine. The market size reflects the increasing recognition of the clinical significance of CTCs in cancer management. As research and development efforts continue to enhance the capabilities of CTC-based diagnostics, the market is poised for continued growth, with the potential to revolutionize cancer diagnostics and treatment strategies.

Leave a Comment