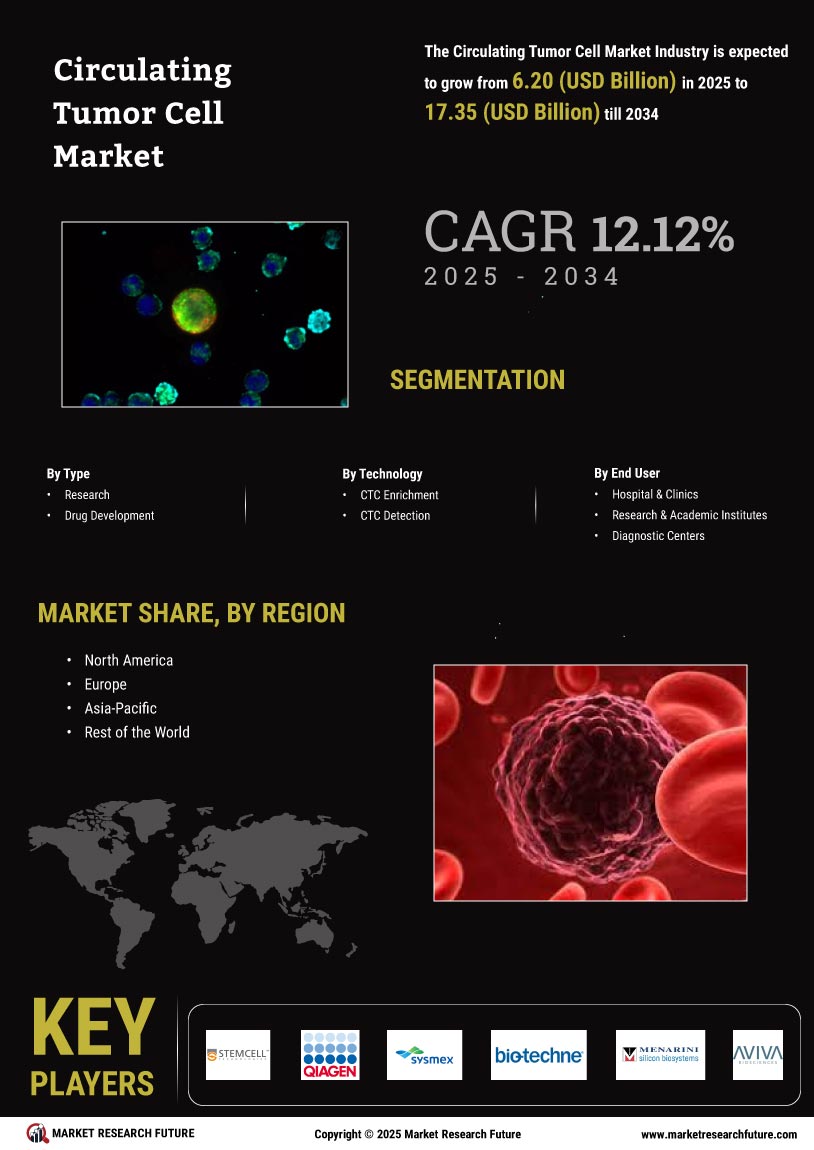

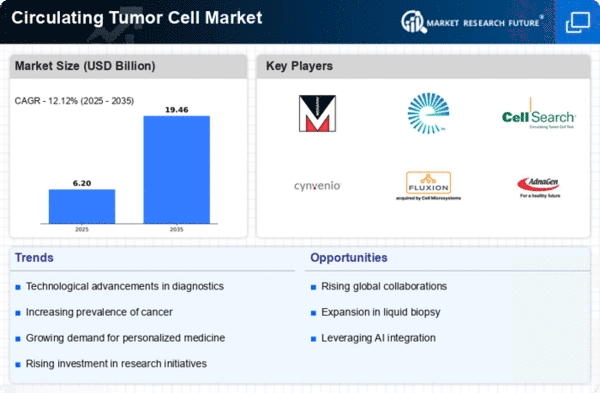

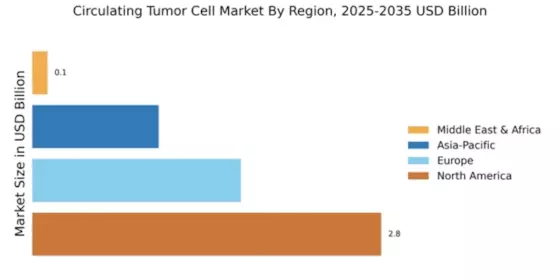

Market Growth Projections

The Global Circulating Tumor Cell Market Industry is projected to experience substantial growth over the next decade. With an estimated market value of 5.53 USD Billion in 2024, it is expected to reach 19.5 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 12.11% from 2025 to 2035. Such projections indicate a robust demand for circulating tumor cell technologies, driven by factors such as increasing cancer incidence, advancements in detection methods, and the rising emphasis on personalized medicine. These metrics highlight the market's potential and the importance of ongoing innovation in the field.

Rising Incidence of Cancer

The increasing prevalence of cancer globally serves as a primary driver for the Global Circulating Tumor Cell Market Industry. As cancer cases rise, the demand for advanced diagnostic tools, including circulating tumor cell technologies, escalates. In 2024, the market is projected to reach 5.53 USD Billion, reflecting a growing recognition of the need for early detection and personalized treatment strategies. This trend is particularly evident in regions with aging populations, where cancer incidence rates are higher. Consequently, the Global Circulating Tumor Cell Market Industry is poised for substantial growth as healthcare systems adapt to these challenges.

Regulatory Support and Guidelines

Regulatory bodies are increasingly recognizing the importance of circulating tumor cell technologies in cancer management, which positively impacts the Global Circulating Tumor Cell Market Industry. Supportive regulatory frameworks facilitate the approval and commercialization of innovative diagnostic Dental Hand Tools, ensuring that they meet safety and efficacy standards. This regulatory backing encourages investment in research and development, further propelling market growth. As the industry evolves, clear guidelines from regulatory authorities will likely enhance the adoption of circulating tumor cell technologies, contributing to the overall expansion of the market.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is reshaping the landscape of the Global Circulating Tumor Cell Market Industry. As healthcare increasingly focuses on tailored treatment approaches, circulating tumor cells play a crucial role in understanding individual patient responses to therapies. This trend is supported by the rising number of clinical trials aimed at integrating circulating tumor cell analysis into treatment protocols. The market's compound annual growth rate of 12.11% from 2025 to 2035 indicates a robust demand for personalized diagnostics and therapeutics, positioning the Global Circulating Tumor Cell Market Industry as a pivotal component of modern oncology.

Increased Research Funding and Collaborations

The Global Circulating Tumor Cell Market Industry benefits from heightened research funding and collaborative efforts among academic institutions, government agencies, and private sectors. This influx of resources fosters innovation and accelerates the development of new technologies and methodologies for circulating tumor cell analysis. For instance, government initiatives aimed at cancer research are likely to enhance the capabilities of circulating tumor cell technologies, leading to improved diagnostic and therapeutic options. As a result, the market is expected to thrive, driven by a collaborative ecosystem that supports advancements in cancer care.

Technological Advancements in Detection Methods

Innovations in detection technologies significantly enhance the capabilities of the Global Circulating Tumor Cell Market Industry. Advanced methodologies, such as microfluidics and next-generation sequencing, improve the sensitivity and specificity of circulating tumor cell detection. These advancements facilitate earlier diagnosis and better monitoring of treatment responses. As a result, healthcare providers are increasingly adopting these technologies, contributing to the market's expansion. The anticipated growth from 2024 to 2035, with a projected market value of 19.5 USD Billion, underscores the importance of continuous innovation in driving the Global Circulating Tumor Cell Market Industry forward.