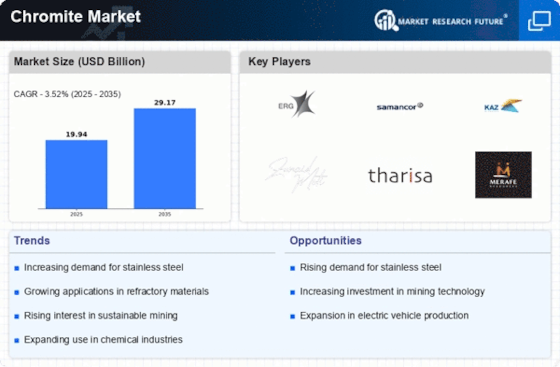

Rising Demand for Stainless Steel

The increasing demand for stainless steel is a primary driver of the Chromite Market. Stainless steel, which contains a significant percentage of chromium, is widely used in various applications, including construction, automotive, and consumer goods. As industries expand and urbanization accelerates, the need for durable and corrosion-resistant materials grows. In 2025, the stainless steel production is projected to reach approximately 50 million metric tons, further boosting the demand for chromite. This trend indicates a robust market for chromite, as it is essential for producing high-quality stainless steel. Consequently, the Chromite Market is likely to experience substantial growth, driven by the ongoing industrialization and infrastructure development across various regions.

Technological Innovations in Mining

Technological advancements in mining processes are transforming the Chromite Market. Innovations such as automated mining equipment, advanced processing techniques, and real-time data analytics enhance efficiency and reduce operational costs. For instance, the adoption of automated systems can increase extraction rates and minimize waste, thereby optimizing the use of chromite resources. Furthermore, the integration of artificial intelligence in mineral processing is expected to improve the quality of chromite produced. As these technologies become more prevalent, they may lead to increased production capacities and lower prices, making chromite more accessible to various industries. This evolution in mining technology is likely to play a crucial role in shaping the future of the Chromite Market.

Geopolitical Factors Affecting Supply Chains

Geopolitical factors play a crucial role in shaping the dynamics of the Chromite Market. Political stability in chromite-producing regions, such as South Africa and Turkey, directly impacts supply chains and pricing. Any disruptions, such as trade disputes or changes in government policies, can lead to fluctuations in chromite availability. In 2025, analysts predict that geopolitical tensions may continue to influence the market, potentially leading to supply shortages or increased prices. Companies operating in the Chromite Market must navigate these complexities to ensure a stable supply of chromite. This geopolitical landscape suggests that strategic partnerships and diversified sourcing may become essential for companies aiming to thrive in the evolving market.

Growing Applications in Aerospace and Defense

The aerospace and defense sectors are emerging as significant consumers of chromite, thereby influencing the Chromite Market. Chromium is a vital component in the production of high-performance alloys used in aircraft and military equipment. As nations invest in modernizing their defense capabilities and expanding their aerospace industries, the demand for chromium-based materials is expected to rise. In 2025, the aerospace sector is anticipated to grow at a compound annual growth rate of around 4.5%, which could lead to increased consumption of chromite. This trend suggests that the Chromite Market will benefit from the heightened focus on advanced materials in these critical sectors, potentially driving prices and production levels upward.

Environmental Regulations and Sustainability Initiatives

The Chromite Market is increasingly influenced by environmental regulations and sustainability initiatives. Governments and organizations are implementing stricter regulations on mining practices to minimize environmental impact. This shift towards sustainable mining practices is prompting companies to adopt eco-friendly technologies and methods. For instance, the use of waste recycling and water conservation techniques in chromite mining can enhance sustainability while maintaining production levels. As consumers and industries prioritize sustainability, the demand for responsibly sourced chromite is likely to increase. This trend may lead to a transformation in the Chromite Market, where companies that prioritize environmental stewardship could gain a competitive advantage.