Expansion of the Cement Industry

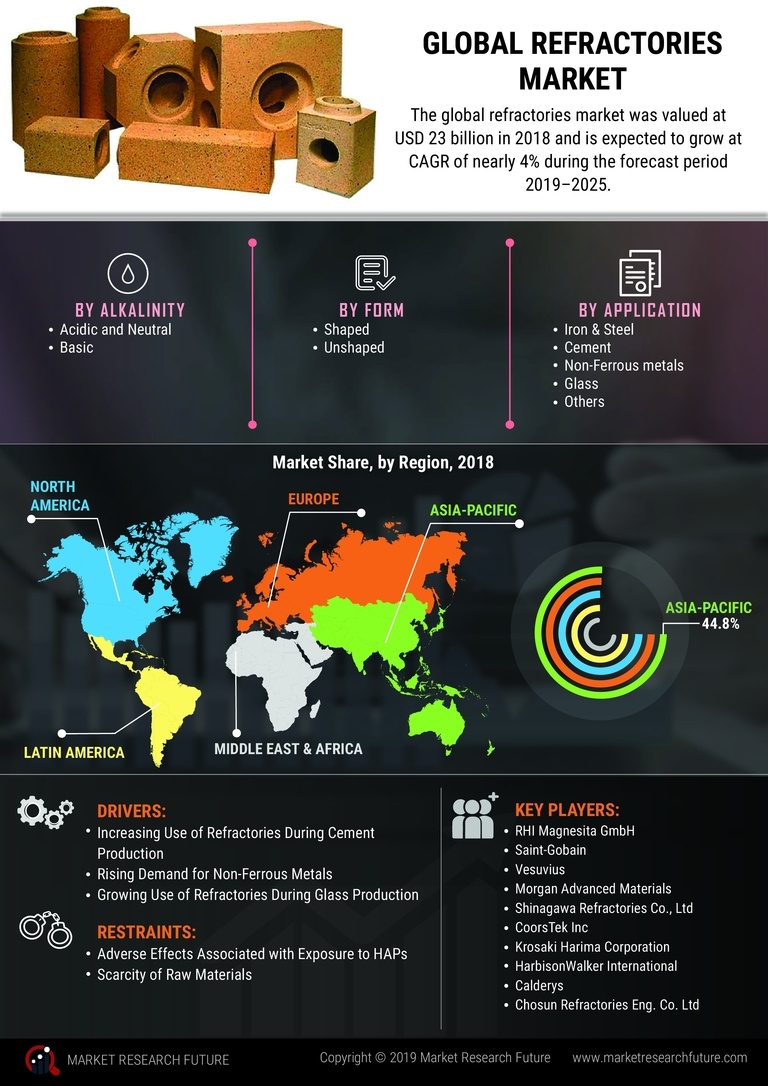

The Refractories Market is significantly influenced by the expansion of the cement sector. Cement production is inherently energy-intensive and requires high-temperature processes, which necessitate the use of high-quality refractories. In recent years, the cement industry has seen a resurgence, with production levels reaching new heights. In 2023, the cement sector represented around 15% of the total refractories market share, highlighting its importance. As countries invest in infrastructure development and urbanization, the demand for cement is projected to rise, subsequently increasing the need for refractories. This trend suggests a symbiotic relationship between the cement industry and the refractories market, where growth in one sector likely fuels growth in the other.

Rising Environmental Regulations

The Refractories Market is also being shaped by the increasing stringency of environmental regulations. Governments worldwide are implementing stricter emissions standards, compelling industries to adopt cleaner technologies. This shift is prompting manufacturers to seek refractories that not only meet performance criteria but also align with sustainability goals. For instance, refractories that minimize waste and enhance energy efficiency are becoming more desirable. The market is witnessing a gradual transition towards eco-friendly refractory solutions, which could potentially reshape product offerings. As industries strive to comply with these regulations, the demand for innovative and sustainable refractories is likely to grow, thereby influencing market dynamics.

Growth in the Petrochemical Sector

The Refractories Market is benefiting from the growth of the petrochemical sector, which is characterized by high-temperature processes that require reliable refractory materials. The petrochemical industry has been expanding due to increasing demand for plastics and other derivatives. In 2023, this sector accounted for approximately 10% of the total refractories consumption, indicating its significant role in the market. As the petrochemical industry continues to evolve, the need for advanced refractories that can withstand harsh operating conditions is expected to rise. This trend suggests that the refractories market will likely see sustained growth as it caters to the specific needs of the petrochemical sector.

Increasing Demand from Steel Industry

The Refractories Market is experiencing a notable surge in demand, primarily driven by the steel sector. As steel production continues to expand, the need for high-performance refractories becomes critical. In 2023, the steel industry accounted for approximately 70% of the total refractories consumption, indicating a robust correlation between steel output and refractory demand. The ongoing investments in infrastructure and construction projects further amplify this trend, as they necessitate the use of refractories in various applications. Additionally, the shift towards electric arc furnaces, which require specialized refractories, is likely to enhance the market's growth trajectory. This increasing reliance on refractories in steel manufacturing underscores their essential role in ensuring operational efficiency and product quality.

Technological Innovations in Refractory Materials

Technological advancements are playing a pivotal role in shaping the Refractories Market. Innovations in material science have led to the development of advanced refractory products that offer superior performance and durability. For instance, the introduction of nanotechnology in refractory formulations has resulted in materials that can withstand higher temperatures and exhibit enhanced thermal shock resistance. This is particularly relevant in industries such as glass and ceramics, where precise temperature control is paramount. Furthermore, the integration of digital technologies in manufacturing processes is streamlining production and improving quality control. As these innovations continue to evolve, they are expected to drive the adoption of advanced refractories, thereby propelling market growth.