Growth in Biopharmaceuticals

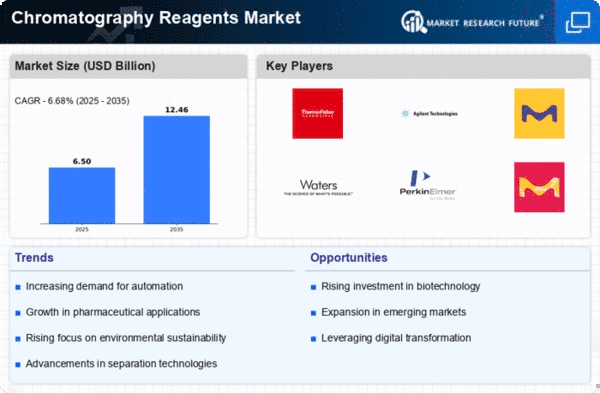

The biopharmaceutical sector significantly influences the Global Chromatography Reagents Market Industry, as the production of biologics requires sophisticated purification processes. Chromatography is essential for the separation and purification of proteins, antibodies, and other biomolecules. The increasing investment in biopharmaceutical research and development, coupled with the rising prevalence of chronic diseases, is expected to propel the market forward. This growth trajectory aligns with a projected CAGR of 5.9% from 2025 to 2035, indicating a robust demand for chromatography reagents tailored for biopharmaceutical applications.

Rising Demand for Analytical Testing

The Global Chromatography Reagents Market Industry experiences a surge in demand for analytical testing across various sectors, including pharmaceuticals, food and beverage, and environmental monitoring. This trend is driven by stringent regulatory requirements that necessitate accurate and reliable testing methods. For instance, the pharmaceutical sector relies heavily on chromatography for drug formulation and quality control. As a result, the market is projected to reach 8.71 USD Billion in 2024, reflecting the increasing need for high-quality reagents that ensure compliance with regulatory standards.

Emerging Markets and Global Expansion

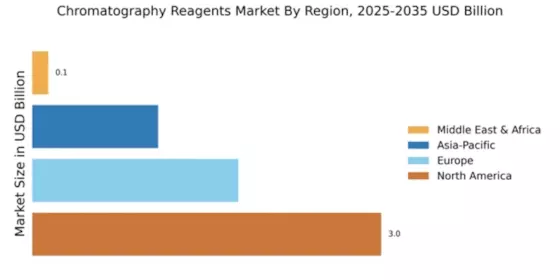

Emerging markets present a significant opportunity for the Global Chromatography Reagents Market Industry as developing economies invest in healthcare and research infrastructure. Countries in Asia-Pacific and Latin America are witnessing rapid growth in laboratory facilities and analytical services, which drives the demand for chromatography reagents. As these regions enhance their research capabilities, the market is likely to experience substantial growth, contributing to the overall expansion of the industry. This trend underscores the importance of global outreach and the need for manufacturers to adapt their strategies to cater to diverse market needs.

Environmental Regulations and Sustainability

Environmental regulations are becoming increasingly stringent, driving the Global Chromatography Reagents Market Industry towards sustainable practices. Industries are compelled to adopt greener methodologies to comply with environmental standards, which often necessitate the use of chromatography for monitoring pollutants and ensuring product safety. The emphasis on sustainability is prompting manufacturers to develop eco-friendly reagents that minimize environmental impact. This shift not only aligns with regulatory compliance but also caters to the growing consumer demand for sustainable products, thereby enhancing market prospects.

Technological Advancements in Chromatography

Technological advancements play a pivotal role in shaping the Global Chromatography Reagents Market Industry. Innovations such as ultra-high-performance liquid chromatography (UHPLC) and advancements in mass spectrometry enhance the efficiency and accuracy of separation techniques. These developments not only improve the resolution of complex mixtures but also reduce analysis time, thereby increasing throughput in laboratories. As these technologies become more accessible, they are likely to drive market growth, contributing to an anticipated market value of 16.4 USD Billion by 2035, as laboratories seek to adopt cutting-edge methodologies.