Rising Demand for Biomarkers

The increasing emphasis on biomarkers in disease diagnosis and treatment is a pivotal driver for the Proteomics Market. Biomarkers play a crucial role in identifying disease states, monitoring therapeutic responses, and predicting patient outcomes. As healthcare systems shift towards precision medicine, the demand for reliable biomarkers is expected to surge. According to recent estimates, the biomarker discovery market is projected to reach approximately 40 billion USD by 2026, indicating a robust growth trajectory. This trend is likely to propel investments in proteomics research, as scientists seek to uncover novel biomarkers through advanced proteomic techniques. Consequently, the Proteomics Market is poised to benefit from this heightened focus on biomarker development, fostering innovation and expanding the scope of proteomic applications in clinical settings.

Advancements in Mass Spectrometry

Technological innovations in mass spectrometry are significantly influencing the Proteomics Market. Mass spectrometry has emerged as a cornerstone technique for protein analysis, enabling researchers to identify and quantify proteins with remarkable accuracy. Recent advancements, such as the development of high-resolution mass spectrometers and novel ionization techniques, have enhanced the sensitivity and throughput of proteomic analyses. The market for mass spectrometry is anticipated to grow at a compound annual growth rate of over 8% through the next few years, reflecting the increasing reliance on this technology in proteomics research. As researchers continue to explore complex biological systems, the Proteomics Market is likely to experience a surge in demand for advanced mass spectrometry solutions, facilitating deeper insights into protein functions and interactions.

Growing Investment in Drug Discovery

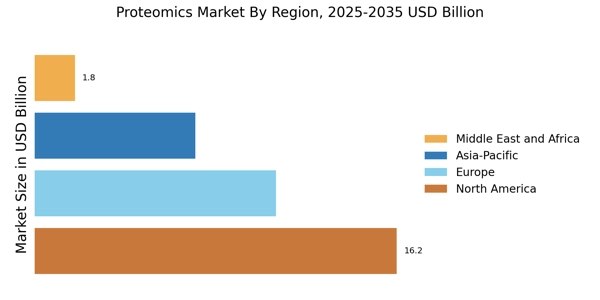

The escalating investment in drug discovery and development is a significant driver for the Proteomics Market. Pharmaceutical companies are increasingly recognizing the value of proteomics in identifying potential drug targets and understanding disease mechanisms. The Proteomics Market is projected to exceed 60 billion USD by 2025, with a substantial portion of this investment directed towards proteomic technologies. This trend is indicative of a broader shift towards integrating proteomics into the drug development pipeline, as it offers insights that traditional methods may overlook. As a result, the Proteomics Market is likely to witness increased collaboration between pharmaceutical firms and proteomics service providers, fostering innovation and expediting the drug discovery process.

Increased Focus on Disease Mechanisms

The heightened focus on understanding disease mechanisms is driving growth in the Proteomics Market. Researchers are increasingly investigating the molecular underpinnings of diseases, aiming to uncover the roles of proteins in various pathological conditions. This trend is reflected in the growing number of research publications and funding initiatives dedicated to proteomics studies. The proteomics research market is projected to grow at a compound annual growth rate of approximately 10% over the next few years, underscoring the increasing importance of proteomic approaches in elucidating disease mechanisms. As a result, the Proteomics Market is likely to experience a surge in demand for proteomic technologies and services, facilitating breakthroughs in disease understanding and treatment strategies.

Emergence of Advanced Bioinformatics Tools

The rise of sophisticated bioinformatics tools is transforming the landscape of the Proteomics Market. As proteomic data becomes increasingly complex, the need for advanced analytical tools to interpret this data is paramount. Bioinformatics platforms that integrate machine learning and artificial intelligence are gaining traction, enabling researchers to analyze large datasets efficiently. The bioinformatics market is expected to grow significantly, with projections indicating a value of over 10 billion USD by 2027. This growth is likely to enhance the capabilities of proteomics research, allowing for more comprehensive analyses of protein interactions and functions. Consequently, the Proteomics Market stands to benefit from the integration of these advanced bioinformatics solutions, which may streamline research processes and improve data interpretation.