Growing Focus on Sustainable Practices

The Chlor Alkali Market is increasingly aligning itself with sustainable practices as environmental concerns gain prominence. Companies are adopting eco-friendly production methods and exploring alternative raw materials to reduce their carbon footprint. This shift is not only a response to consumer demand for greener products but also a strategic move to comply with evolving regulations. For instance, the use of renewable energy sources in the production of chlor alkali products is becoming more prevalent, which could potentially lower greenhouse gas emissions. As sustainability becomes a core component of business strategies, the Chlor Alkali Market is likely to see enhanced brand loyalty and market positioning, ultimately driving growth.

Rising Demand for Chlor Alkali Products

The Chlor Alkali Market is experiencing a notable increase in demand for its products, particularly chlorine, caustic soda, and soda ash. This surge is largely driven by the expanding applications in various sectors, including water treatment, chemical manufacturing, and the production of plastics. For instance, the demand for caustic soda is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years, reflecting its essential role in the production of alumina and detergents. Furthermore, the increasing focus on water purification and sanitation is likely to bolster the demand for chlorine, which is a key disinfectant. As industries continue to expand, the Chlor Alkali Market is poised to benefit from this rising demand.

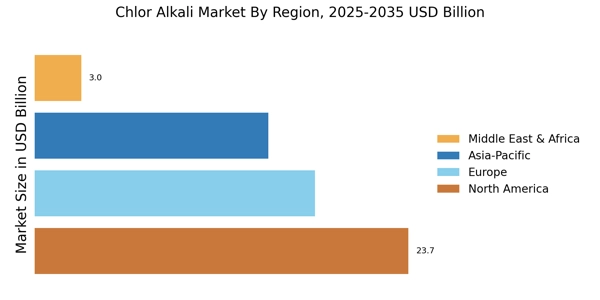

Expanding Applications in Emerging Markets

The Chlor Alkali Market is witnessing a diversification of applications, particularly in emerging markets. The increasing urbanization and industrialization in regions such as Asia-Pacific and Latin America are driving the demand for chlor alkali products in sectors like construction, textiles, and agriculture. For example, the use of caustic soda in the textile industry for fabric processing is gaining traction, while chlorine is essential for producing various agricultural chemicals. This trend indicates a broader acceptance and integration of chlor alkali products across different industries, which could lead to substantial growth opportunities. As these markets continue to develop, the Chlor Alkali Market is well-positioned to capitalize on this expanding demand.

Regulatory Support for Environmental Standards

The Chlor Alkali Market is significantly influenced by regulatory frameworks aimed at promoting environmental sustainability. Governments are increasingly implementing stringent regulations regarding chemical production and waste management, which encourages the adoption of cleaner technologies in the chlor alkali sector. For example, regulations that limit the discharge of hazardous substances are prompting manufacturers to invest in advanced production methods that minimize environmental impact. This shift not only aligns with The Chlor Alkali Industry. As a result, firms that proactively adapt to these regulations may gain a substantial market advantage, potentially leading to increased market share and profitability.

Technological Innovations in Production Processes

Technological advancements are playing a crucial role in shaping the Chlor Alkali Market. Innovations such as membrane cell technology and improved electrolysis processes are enhancing production efficiency and reducing energy consumption. For instance, membrane cell technology has been shown to decrease energy usage by up to 30% compared to traditional methods, which is a significant factor given the rising energy costs. Additionally, these technologies contribute to lower operational costs and reduced environmental footprints, making them attractive to manufacturers. As companies continue to invest in research and development, the Chlor Alkali Market is likely to witness a transformation that not only boosts productivity but also aligns with sustainability objectives.