Expansion of E-commerce Platforms

The vitamin test market is benefiting from the rapid expansion of e-commerce platforms in China. With the increasing penetration of the internet and mobile devices, consumers are increasingly turning to online channels for health-related products and services. E-commerce platforms provide convenient access to vitamin testing kits and related services, making it easier for consumers to monitor their health. Recent statistics indicate that online retail sales in China are expected to reach over $2 trillion by 2025, which could significantly enhance the visibility and accessibility of vitamin testing services. This trend suggests a promising future for the vitamin test market as e-commerce continues to thrive.

Integration of Health Technologies

The integration of health technologies into the vitamin test market is transforming how consumers approach their nutritional health. Innovations such as mobile health applications and wearable devices are enabling individuals to track their vitamin levels and overall health metrics more effectively. These technologies provide real-time data and personalized recommendations, fostering a more proactive approach to health management. As the adoption of health technologies continues to rise, it is expected that the vitamin test market will expand, as consumers increasingly rely on these tools to monitor their nutritional status and make informed decisions about their health.

Increasing Demand for Preventive Healthcare

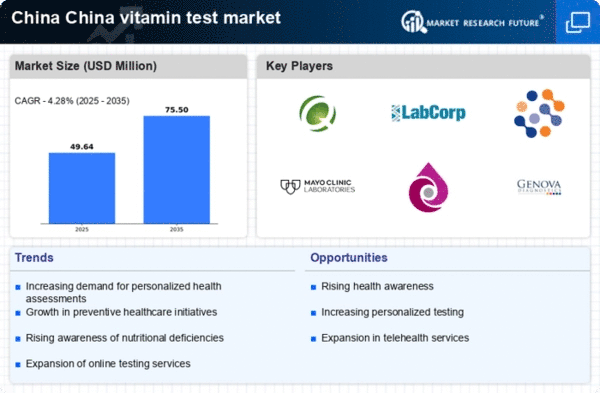

The vitamin test market in China is experiencing a notable surge due to the increasing demand for preventive healthcare. As consumers become more health-conscious, they are seeking proactive measures to monitor their nutritional status. This trend is reflected in the growing number of individuals opting for vitamin testing services, which allow for personalized health assessments. According to recent data, the preventive healthcare sector in China is projected to grow at a CAGR of approximately 10% over the next five years. This growth is likely to drive the vitamin test market, as more people recognize the importance of maintaining optimal vitamin levels to prevent chronic diseases.

Rising Incidence of Nutritional Deficiencies

The vitamin test market is also influenced by the rising incidence of nutritional deficiencies among the Chinese population. Factors such as urbanization, changing dietary habits, and increased consumption of processed foods have led to a decline in the intake of essential vitamins. Reports indicate that approximately 30% of the population may be at risk of vitamin D deficiency, highlighting the need for regular testing. This alarming trend is prompting healthcare providers to recommend vitamin testing as a routine part of health assessments. Consequently, the vitamin test market is likely to see increased demand as individuals seek to identify and address potential deficiencies.

Government Initiatives Promoting Health Awareness

Government initiatives aimed at promoting health awareness are playing a crucial role in shaping the vitamin test market in China. Various campaigns and programs are being launched to educate the public about the importance of vitamins and their impact on overall health. These initiatives often include free or subsidized vitamin testing services, which encourage individuals to assess their nutritional status. As a result, there is a growing awareness of vitamin deficiencies and the need for regular testing. This heightened awareness is likely to contribute to the expansion of the vitamin test market, as more individuals seek to understand their health better.