Aging Population

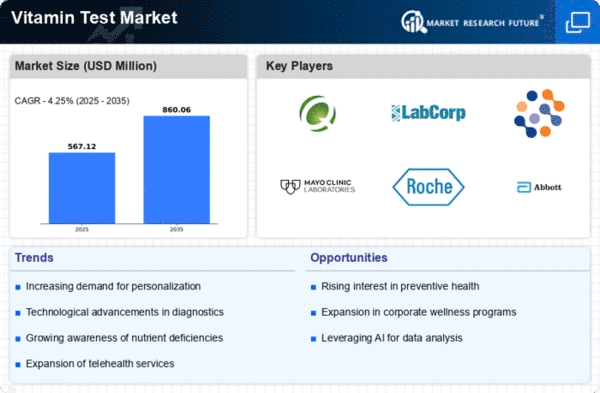

The demographic shift towards an aging population is likely to influence the Global Vitamin Test Market Industry. Older adults often face various health challenges, including nutritional deficiencies, which necessitate regular vitamin assessments. This demographic trend indicates a growing need for vitamin testing services tailored to the elderly. As the global population aged 65 and over continues to expand, the demand for vitamin tests may increase correspondingly. This could lead to a compound annual growth rate of 4.26% from 2025 to 2035, reflecting the market's responsiveness to the health needs of older individuals.

Rising Health Awareness

The increasing global focus on health and wellness appears to drive the Global Vitamin Test Market Industry. As individuals become more conscious of their nutritional intake, the demand for vitamin testing services is likely to rise. This trend is evident in various regions, where healthcare providers emphasize preventive care. For instance, in 2024, the market is projected to reach 0.54 USD Billion, reflecting a growing inclination towards personalized health assessments. This heightened awareness may lead to a more informed consumer base, potentially increasing the uptake of vitamin testing services and products.

Technological Advancements

Technological innovations in diagnostic tools and testing methodologies seem to significantly enhance the Global Vitamin Test Market Industry. The introduction of advanced testing kits and mobile applications facilitates easier access to vitamin testing for consumers. For example, point-of-care testing devices allow individuals to assess their vitamin levels at home, thereby promoting proactive health management. As these technologies evolve, they could contribute to a projected market growth to 0.85 USD Billion by 2035. This evolution in testing technology may not only improve accuracy but also expand the reach of vitamin testing services globally.

Growing Demand for Personalized Nutrition

The rising trend of personalized nutrition is likely to propel the Global Vitamin Test Market Industry. Consumers are increasingly seeking tailored dietary recommendations based on their individual health profiles, which often necessitates vitamin testing. This demand for customized health solutions may drive the adoption of vitamin testing services, as individuals aim to optimize their nutrient intake. The market's growth trajectory, with a forecasted increase to 0.54 USD Billion in 2024, indicates a shift towards more personalized approaches in health management. This trend may encourage consumers to engage more actively in their nutritional health.

Integration of Vitamin Testing in Healthcare

The integration of vitamin testing into routine healthcare practices appears to be a significant driver for the Global Vitamin Test Market Industry. Healthcare providers increasingly recognize the importance of assessing vitamin levels as part of comprehensive health evaluations. This integration may lead to more frequent testing and monitoring of vitamin levels among patients. As healthcare systems worldwide adopt preventive health measures, the market is expected to benefit from this trend. The projected growth to 0.85 USD Billion by 2035 suggests that healthcare professionals are likely to prioritize vitamin testing as a standard practice.