Growing Aging Population

The aging population in Germany is a significant driver of the vitamin test market. As individuals age, their nutritional needs change, and they may become more susceptible to vitamin deficiencies. This demographic shift is prompting a greater focus on health management among older adults, who are increasingly seeking vitamin testing to ensure they maintain adequate nutrient levels. The vitamin test market is likely to expand as healthcare providers emphasize the importance of regular testing for this age group. With projections indicating that the percentage of individuals aged 65 and older will reach 25% by 2030, the market is poised for substantial growth.

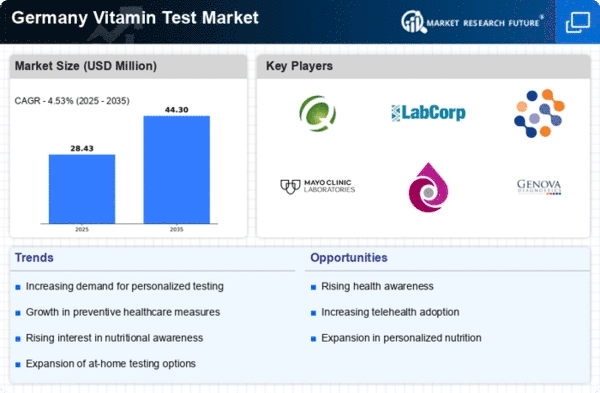

Increasing Health Awareness

The vitamin test market in Germany is experiencing growth due to a notable increase in health awareness among the population. Individuals are becoming more proactive about their health, seeking to understand their nutritional status through testing. This trend is reflected in the rising demand for vitamin tests, as consumers aim to identify deficiencies and optimize their health. According to recent data, approximately 60% of Germans express interest in regular health check-ups, which includes vitamin testing. This heightened awareness is likely to drive the vitamin test market, as more people prioritize preventive measures and personalized health strategies.

Integration of Digital Health Solutions

The integration of digital health solutions is transforming the vitamin test market in Germany. With the rise of telehealth and mobile health applications, consumers can now access vitamin testing services more conveniently. This trend is indicative of a broader shift towards digitalization in healthcare, where patients can receive results and recommendations through online platforms. The vitamin test market is likely to benefit from this trend, as it enhances accessibility and encourages more individuals to engage in health monitoring. The convenience offered by digital solutions may lead to an increase in testing frequency among consumers.

Rising Demand for Personalized Nutrition

The vitamin test market is significantly influenced by the growing demand for personalized nutrition solutions in Germany. Consumers are increasingly seeking tailored dietary recommendations based on their individual health profiles. This trend is supported by advancements in testing technologies that allow for more accurate assessments of vitamin levels. As a result, the vitamin test market is likely to expand, with a projected growth rate of around 8% annually. This shift towards personalized health solutions indicates a broader movement towards individualized care, which is expected to further enhance the market's appeal.

Government Initiatives for Health Promotion

Government initiatives aimed at promoting health and wellness are playing a crucial role in shaping the vitamin test market in Germany. Various public health campaigns encourage citizens to monitor their nutritional intake and consider regular testing for vitamin deficiencies. These initiatives are likely to foster a culture of health consciousness, thereby increasing the demand for vitamin tests. The vitamin test market may see a boost as more individuals become aware of the importance of maintaining optimal vitamin levels for overall health. Such government support could potentially lead to a more informed population regarding their nutritional needs.