Rising Concerns Over Public Safety

Public safety concerns are a significant driver of the video surveillance-as-a-service market in China. With urban areas facing challenges such as crime and civil unrest, there is a pressing need for effective surveillance solutions. Government initiatives aimed at enhancing public safety are likely to bolster the adoption of video surveillance systems. In 2025, it is anticipated that public sector investments in surveillance technologies will account for nearly 40% of the total market share. This trend reflects a broader commitment to ensuring safety in public spaces, transportation hubs, and critical infrastructure. As a result, the video surveillance-as-a-service market is positioned to grow in response to these heightened safety demands.

Cost-Effectiveness of Subscription Models

The video surveillance-as-a-service market is experiencing growth due to the cost-effective nature of subscription-based models. Organizations in China are increasingly opting for these services as they eliminate the need for substantial upfront investments in hardware and software. Instead, clients can access high-quality surveillance solutions through manageable monthly fees. This model not only reduces capital expenditure but also allows for scalability, enabling businesses to adjust their surveillance needs as they grow. In 2025, it is estimated that around 60% of new installations will adopt a subscription model, indicating a shift in purchasing behavior. This trend is particularly appealing to small and medium-sized enterprises that may lack the resources for traditional systems.

Increased Focus on Smart City Initiatives

The push towards smart city initiatives in China is significantly impacting the video surveillance-as-a-service market. As cities evolve to incorporate smart technologies, the integration of advanced surveillance systems becomes essential for urban management. These initiatives aim to enhance public services, improve traffic management, and ensure safety. By 2025, it is projected that investments in smart city projects will drive a substantial portion of the demand for video surveillance solutions, with an expected growth rate of 18%. The ability to collect and analyze data from surveillance systems contributes to more informed decision-making and resource allocation, making video surveillance-as-a-service a critical component of smart city frameworks.

Growing Demand for Enhanced Security Solutions

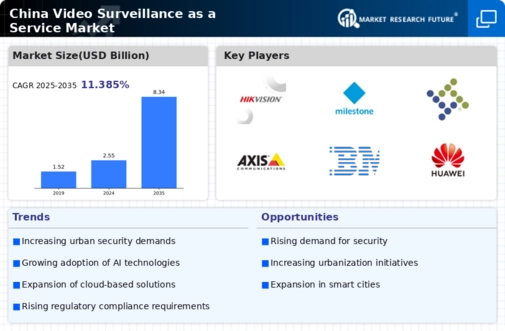

The increasing need for robust security measures across various sectors in China is driving the video surveillance-as-a-service market. With urbanization and population density rising, businesses and government entities are prioritizing safety. In 2025, the market is projected to reach a valuation of approximately $3 billion, reflecting a compound annual growth rate (CAGR) of around 15%. This demand is particularly evident in retail, transportation, and public safety sectors, where surveillance systems are essential for crime prevention and incident management. The integration of advanced technologies, such as facial recognition and motion detection, further enhances the appeal of video surveillance-as-a-service solutions, making them indispensable for organizations aiming to protect assets and ensure safety.

Technological Advancements in Surveillance Systems

Technological innovations are significantly influencing the video surveillance-as-a-service market in China. The advent of high-definition cameras, cloud storage, and artificial intelligence capabilities has transformed traditional surveillance into a more efficient and effective solution. In 2025, the market is expected to benefit from advancements such as real-time analytics and remote monitoring, which enhance operational efficiency. These technologies not only improve the quality of surveillance footage but also enable proactive responses to incidents. As organizations seek to leverage these advancements, the demand for video surveillance-as-a-service solutions is likely to increase, with projections indicating a market growth of approximately 20% in sectors like transportation and logistics.