Increased Focus on Sustainability

The growing emphasis on sustainability within the telecommunications sector is a notable driver for the telecom tower-power-system market. As environmental concerns gain prominence, telecom companies in China are increasingly adopting green practices. This includes the implementation of renewable energy sources, such as solar and wind, to power telecom towers. Reports suggest that by 2025, approximately 30% of telecom towers in urban areas may utilize renewable energy solutions. This shift not only aligns with global sustainability goals but also reduces operational costs in the long run. Consequently, the telecom tower-power-system market is likely to witness a surge in demand for eco-friendly power systems that support these initiatives.

Rising Demand for Mobile Connectivity

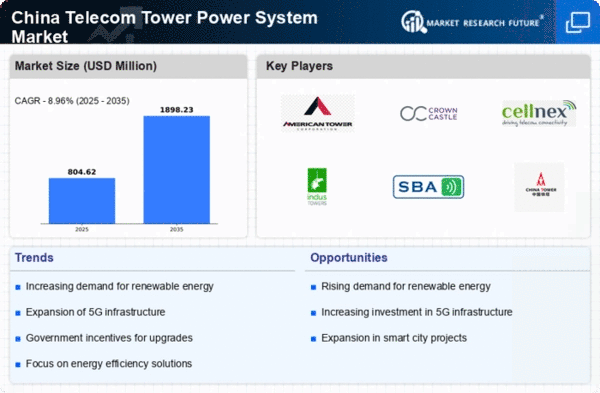

The increasing demand for mobile connectivity in China is a primary driver for the telecom tower-power-system market. With the rapid growth of smartphone penetration, which reached approximately 1.6 billion units in 2025, the need for robust telecom infrastructure has surged. This demand is further fueled by the expansion of 5G networks, which require more power-efficient systems to support higher data transmission rates. As urbanization continues, cities are witnessing a proliferation of telecom towers, necessitating advanced power systems to ensure reliability and efficiency. The telecom tower-power-system market is expected to grow significantly. Projections indicate a compound annual growth rate (CAGR) of around 10% over the next five years, driven by this insatiable demand for connectivity..

Technological Advancements in Power Systems

Technological advancements in power systems are reshaping the telecom tower-power-system market in China. Innovations such as energy storage solutions, smart grid technologies, and advanced monitoring systems are becoming increasingly prevalent. These technologies not only improve the efficiency of power consumption but also enhance the reliability of telecom operations. For instance, the integration of battery storage systems can reduce reliance on traditional power sources, potentially lowering operational costs by up to 20%. As telecom operators seek to optimize their energy usage, the demand for sophisticated power systems is expected to rise, driving growth in the market. The ongoing evolution of technology presents both challenges and opportunities for stakeholders in the telecom tower-power-system market.

Competitive Landscape and Market Consolidation

The competitive landscape of the telecom tower-power-system market in China is evolving, with increasing consolidation among key players. Major telecom operators are seeking to enhance their market position through strategic partnerships and acquisitions, which can lead to improved efficiencies and cost reductions. This trend is likely to drive innovation in power systems, as companies invest in research and development to create more efficient and reliable solutions. The market is projected to experience a shift towards integrated service providers that offer comprehensive power solutions alongside telecom services. As competition intensifies, the telecom tower-power-system market may see accelerated growth, driven by the need for advanced technologies and improved service delivery.

Government Initiatives for Infrastructure Development

Government initiatives aimed at enhancing telecommunications infrastructure in China are significantly impacting the telecom tower-power-system market. The Chinese government has allocated substantial funding, estimated at $50 billion, for the development of telecom infrastructure, particularly in rural and underserved areas. This investment is intended to bridge the digital divide and ensure equitable access to mobile services. Additionally, policies promoting the deployment of energy-efficient power systems are likely to gain traction, as the government emphasizes sustainability. The telecom tower-power-system market stands to benefit from these initiatives, as they create opportunities for innovation and the adoption of advanced technologies that enhance operational efficiency.