Expansion of 5G Infrastructure

The rollout of 5G infrastructure in China serves as a critical driver for the telecom analytics market. With the government prioritizing the development of 5G networks, telecom operators are compelled to adopt analytics solutions to manage the complexities associated with this advanced technology. The telecom analytics market is expected to benefit from the anticipated increase in data traffic, which is projected to grow by over 50% annually as 5G adoption accelerates. This influx of data necessitates robust analytics capabilities to monitor network performance, optimize resource allocation, and enhance user experiences. As a result, the expansion of 5G infrastructure not only propels the telecom analytics market forward but also encourages innovation in analytics tools tailored for 5G environments.

Rising Demand for Data-Driven Insights

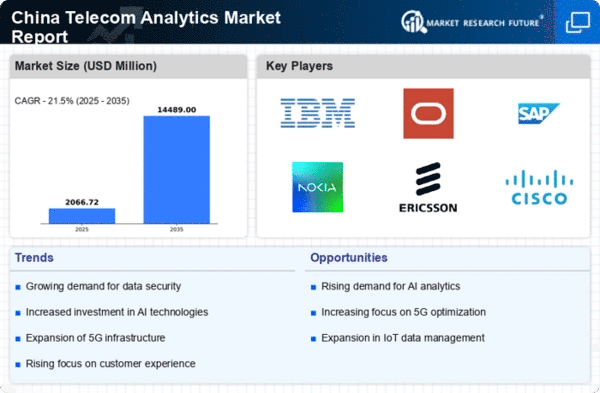

The telecom analytics market in China experiences a notable surge in demand for data-driven insights. As telecom operators seek to optimize their operations, the need for advanced analytics tools becomes increasingly apparent. In 2025, the market is projected to reach approximately $2 billion, reflecting a compound annual growth rate (CAGR) of around 15%. This growth is driven by the necessity for operators to analyze vast amounts of data generated by users, enabling them to make informed decisions. The ability to harness data effectively allows companies to enhance service delivery, improve network performance, and ultimately drive customer satisfaction. Consequently, the rising demand for data-driven insights significantly influences the telecom analytics market, pushing operators to invest in sophisticated analytics solutions.

Growing Focus on Operational Efficiency

In the context of the telecom analytics market, the growing focus on operational efficiency among telecom operators in China is a significant driver. Companies are increasingly recognizing the importance of streamlining their operations to reduce costs and improve service delivery. By leveraging analytics, operators can identify inefficiencies, optimize resource utilization, and enhance overall performance. The market is projected to witness a growth rate of approximately 12% annually as operators invest in analytics solutions that provide actionable insights. This trend indicates a shift towards data-centric decision-making, where analytics plays a pivotal role in driving operational improvements. Consequently, the emphasis on operational efficiency is likely to shape the future landscape of the telecom analytics market.

Increased Competition Among Telecom Providers

The telecom analytics market in China is significantly influenced by the increased competition among telecom providers. As the market becomes saturated, operators are compelled to differentiate themselves through enhanced service offerings and customer engagement strategies. Analytics tools enable providers to gain insights into customer behavior, preferences, and usage patterns, allowing for targeted marketing and personalized services. This competitive landscape is expected to drive the telecom analytics market, with an estimated growth of 10% annually as companies seek to leverage data for strategic advantages. The ability to analyze customer data effectively not only fosters loyalty but also enhances revenue generation opportunities, making competition a key driver in the telecom analytics market.

Regulatory Changes and Compliance Requirements

Regulatory changes and compliance requirements in China are emerging as a crucial driver for the telecom analytics market. As the government implements stricter data protection laws and regulations, telecom operators must adapt their analytics practices to ensure compliance. This shift necessitates the adoption of advanced analytics solutions that can effectively manage and secure customer data. The telecom analytics market is projected to grow by approximately 8% annually as companies invest in compliance-driven analytics tools. These tools not only help in adhering to regulations but also enhance data security and customer trust. Therefore, the evolving regulatory landscape is likely to play a significant role in shaping the telecom analytics market.