Growing Cybersecurity Threats

The increasing frequency and sophistication of cyber threats in China is a primary driver for the China security operations center market. As organizations face a surge in cyberattacks, including ransomware and data breaches, the demand for robust security operations centers (SOCs) has escalated. According to recent statistics, the number of reported cyber incidents in China has risen by over 30% in the past year alone. This alarming trend compels businesses to invest in advanced SOC solutions to safeguard their digital assets. Furthermore, the Chinese government has emphasized the importance of cybersecurity, leading to increased funding and support for SOC initiatives. Consequently, the growing awareness of cybersecurity risks is likely to propel the growth of the China security operations center market in the coming years.

Rising Awareness of Data Privacy

The heightened awareness of data privacy among consumers and businesses in China is emerging as a crucial driver for the China security operations center market. With the implementation of stringent data protection regulations, organizations are increasingly prioritizing the safeguarding of sensitive information. The demand for SOCs is likely to grow as companies seek to ensure compliance with these regulations and protect their reputations. Furthermore, public concern regarding data breaches has prompted businesses to invest in advanced security measures, including SOCs, to mitigate risks. As organizations strive to build trust with their customers, the focus on data privacy is expected to significantly influence the growth trajectory of the China security operations center market.

Emergence of Advanced Technologies

The rapid advancement of technologies such as artificial intelligence, machine learning, and big data analytics is transforming the landscape of the China security operations center market. These technologies enable SOCs to enhance their threat detection and response capabilities, making them more effective in combating cyber threats. The integration of AI-driven solutions allows for real-time analysis of security incidents, thereby improving incident response times. As organizations in China increasingly adopt these advanced technologies, the demand for sophisticated SOC solutions is likely to rise. This trend indicates that the evolution of technology will play a pivotal role in shaping the future of the China security operations center market, as businesses seek to leverage innovative solutions to bolster their cybersecurity posture.

Government Initiatives and Policies

The Chinese government has implemented various initiatives aimed at enhancing national cybersecurity, which serves as a significant driver for the China security operations center market. Policies such as the Cybersecurity Law and the National Cybersecurity Strategy underscore the government's commitment to strengthening the country's cyber defenses. These regulations mandate organizations to establish SOCs to monitor and respond to security incidents effectively. Additionally, the government has allocated substantial resources to support the development of cybersecurity infrastructure, including SOCs. This proactive approach not only fosters a conducive environment for SOC growth but also encourages private sector participation in the cybersecurity landscape. As a result, the alignment of government policies with market needs is expected to stimulate the expansion of the China security operations center market.

Increased Investment in Digital Transformation

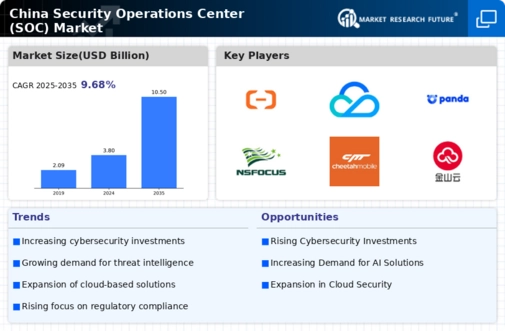

The ongoing digital transformation across various sectors in China is driving the demand for security operations centers. As organizations adopt cloud computing, IoT, and AI technologies, the complexity of their IT environments increases, necessitating enhanced security measures. The China security operations center market is witnessing a surge in investments as companies recognize the need for comprehensive security solutions to protect their digital assets. Recent data indicates that the investment in cybersecurity solutions in China is projected to reach USD 30 billion by 2026, reflecting a growing commitment to safeguarding digital infrastructures. This trend suggests that as businesses continue to embrace digitalization, the demand for SOCs will likely rise, further propelling the growth of the China security operations center market.