Growing Awareness of Environmental Impact

The growing awareness of the environmental impact of medical waste is increasingly driving the refurbished medical-devices market. Healthcare providers in China are becoming more conscious of their ecological footprint and are seeking ways to minimize waste. Refurbished medical devices present an attractive alternative, as they contribute to waste reduction by extending the lifecycle of existing equipment. This shift towards sustainability is not only beneficial for the environment but also aligns with the values of patients who are increasingly concerned about ecological issues. As healthcare facilities adopt greener practices, the refurbished medical-devices market is likely to see a surge in demand, as providers look for solutions that are both cost-effective and environmentally friendly.

Rising Investment in Healthcare Infrastructure

Rising investment in healthcare infrastructure in China is a significant driver for the refurbished medical-devices market. As the government and private sector continue to invest heavily in healthcare facilities, there is an increasing need for medical equipment. However, budget constraints often limit the ability to purchase new devices. Refurbished medical devices offer a practical solution, allowing healthcare providers to equip their facilities without overspending. The refurbished medical-devices market is poised to benefit from this trend, as investments in healthcare infrastructure are expected to grow by approximately 10% annually. This influx of capital into the healthcare sector is likely to create a robust demand for refurbished medical devices, further propelling market growth.

Increasing Demand for Affordable Healthcare Solutions

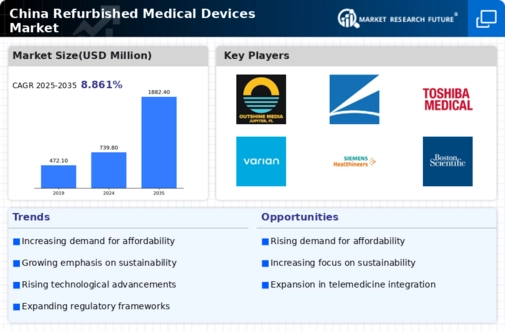

The rising demand for affordable healthcare solutions in China is a primary driver for the refurbished medical-devices market. As healthcare costs continue to escalate, hospitals and clinics are increasingly seeking cost-effective alternatives to new medical equipment. This trend is particularly pronounced in rural areas, where budget constraints are more severe. The refurbished medical-devices market offers a viable solution, providing high-quality equipment at a fraction of the cost, often up to 50% less than new devices. This affordability not only helps healthcare providers manage their budgets but also ensures that patients receive necessary medical care without excessive financial burden. Consequently, the increasing demand for affordable healthcare solutions is likely to propel the growth of the refurbished medical-devices market in China.

Technological Advancements in Refurbishment Processes

Technological advancements in refurbishment processes are significantly influencing the refurbished medical-devices market. Innovations in diagnostic and repair technologies have enhanced the quality and reliability of refurbished devices, making them more appealing to healthcare providers. For instance, advanced sterilization techniques and software updates ensure that refurbished devices meet or exceed original manufacturer specifications. This improvement in quality is crucial, as it addresses concerns regarding the safety and efficacy of refurbished equipment. As a result, healthcare facilities are more inclined to invest in refurbished devices, which can be up to 30% cheaper than new ones. The ongoing evolution of refurbishment technologies is expected to further stimulate the growth of the refurbished medical-devices market in China.

Government Initiatives Promoting Medical Equipment Recycling

Government initiatives aimed at promoting medical equipment recycling are playing a pivotal role in the refurbished medical-devices market. The Chinese government has implemented policies encouraging the recycling and refurbishment of medical devices to reduce waste and promote sustainability. These initiatives not only help in managing healthcare waste but also support the development of a circular economy within the healthcare sector. By providing incentives for hospitals to refurbish and reuse medical equipment, the government is fostering a more sustainable approach to healthcare. This regulatory support is likely to enhance market confidence, encouraging more healthcare providers to consider refurbished devices as a viable option. As a result, the refurbished medical-devices market is expected to benefit from these government-led initiatives.