Aging Population

China's aging population is a crucial factor influencing the china precision medical device market. With over 250 million individuals aged 60 and above, the demand for precision medical devices is expected to surge. This demographic shift necessitates advanced medical solutions to address age-related health issues, such as chronic diseases and mobility impairments. The National Health Commission has projected that by 2030, the elderly population will exceed 300 million, further intensifying the need for innovative medical devices. Consequently, manufacturers are likely to focus on developing specialized products tailored to the needs of older adults, thereby driving growth in the china precision medical device market. This demographic trend underscores the importance of precision medicine in enhancing the quality of life for the aging population.

Technological Advancements

Technological advancements play a significant role in shaping the china precision medical device market. Innovations in areas such as robotics, imaging technologies, and minimally invasive procedures are transforming the landscape of medical devices. For instance, the integration of 3D printing technology has enabled the production of customized implants and prosthetics, catering to individual patient needs. The market for advanced imaging devices, such as MRI and CT scanners, is projected to grow substantially, reflecting the increasing demand for precise diagnostics. In 2025, the market for imaging devices alone is expected to reach 300 billion yuan. These technological developments not only enhance the efficacy of medical treatments but also contribute to the overall growth of the china precision medical device market, as healthcare providers seek to adopt the latest innovations.

Rising Healthcare Expenditure

The increasing healthcare expenditure in China is a pivotal driver for the china precision medical device market. As the government prioritizes healthcare reforms, spending on medical devices is projected to rise significantly. In 2025, healthcare expenditure in China reached approximately 7.2 trillion yuan, reflecting a compound annual growth rate of around 10%. This trend indicates a growing demand for precision medical devices, as hospitals and clinics seek advanced technologies to improve patient outcomes. Furthermore, the expansion of health insurance coverage is likely to enhance access to these devices, thereby stimulating market growth. The emphasis on quality healthcare services aligns with the objectives of the china precision medical device market, fostering innovation and investment in cutting-edge medical technologies.

Government Support and Policies

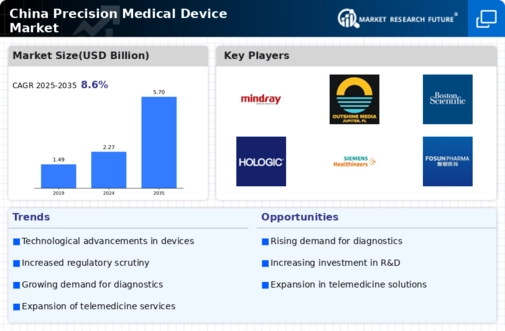

The Chinese government has implemented various supportive policies to bolster the china precision medical device market. Initiatives such as the 'Made in China 2025' plan aim to enhance domestic manufacturing capabilities and promote innovation in medical technology. Additionally, the government has introduced favorable tax incentives and funding programs for research and development in the medical device sector. In 2025, the market for precision medical devices is anticipated to reach 1 trillion yuan, driven by these supportive measures. Furthermore, regulatory reforms aimed at expediting the approval process for new medical devices are likely to encourage investment and innovation. This proactive governmental approach is expected to create a conducive environment for the growth of the china precision medical device market.

Growing Demand for Home Healthcare Solutions

The growing demand for home healthcare solutions is emerging as a significant driver for the china precision medical device market. As patients increasingly prefer receiving care in the comfort of their homes, there is a rising need for precision medical devices that facilitate remote monitoring and treatment. The market for home healthcare devices is projected to reach 200 billion yuan by 2025, reflecting a shift towards patient-centric care models. This trend is further supported by advancements in telemedicine and wearable technologies, which enable healthcare providers to monitor patients' health remotely. Consequently, manufacturers are likely to invest in developing user-friendly and efficient home healthcare devices, thereby propelling the growth of the china precision medical device market. This shift towards home-based care underscores the evolving landscape of healthcare delivery in China.