Growing Aging Population

The demographic shift towards an aging population in China is significantly influencing the prebiotics market. As the population ages, there is a heightened focus on health and wellness, particularly concerning digestive health. Older adults are increasingly seeking dietary solutions that can help manage age-related health issues, including digestive disorders. This demographic trend is expected to drive demand for prebiotic products, as they are recognized for their potential to support gut health and overall well-being. Market analysts project that the aging population will contribute to a growth rate of around 7% in the prebiotics market over the next few years. Consequently, manufacturers are likely to tailor their offerings to meet the specific needs of older consumers, further propelling market expansion.

Expansion of E-commerce Platforms

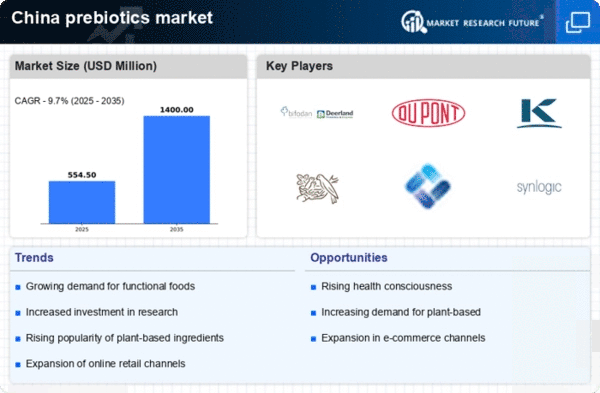

The rise of e-commerce platforms in China is significantly impacting the prebiotics market. With the increasing penetration of the internet and mobile devices, consumers are turning to online shopping for convenience and variety. E-commerce platforms provide a vast array of prebiotic products, allowing consumers to easily compare options and access detailed information about health benefits. This shift is reflected in the sales data, which indicates that online sales of health supplements, including prebiotics, have grown by over 30% in the past year. The accessibility of prebiotic products through e-commerce is likely to enhance market growth, as it caters to the preferences of tech-savvy consumers who value convenience and efficiency in their purchasing decisions.

Rising Interest in Functional Foods

The prebiotics market in China is witnessing a significant increase in the popularity of functional foods. These foods, which are enhanced with prebiotics, are becoming a staple in the diets of health-conscious consumers. The trend is driven by a growing understanding of the health benefits associated with prebiotics, such as improved gut health and enhanced immune function. Market Research Future indicates that the functional food sector is expected to grow by approximately 10% annually, with prebiotic-enriched products leading the charge. This growth reflects a broader consumer shift towards foods that not only satisfy hunger but also contribute to overall health. As a result, manufacturers are increasingly focusing on developing innovative functional food products that incorporate prebiotics, thereby expanding the prebiotics market.

Increasing Demand for Digestive Health Products

The prebiotics market in China is experiencing a notable surge in demand for products that promote digestive health. This trend is largely driven by a growing awareness among consumers regarding the importance of gut health. As individuals become more health-conscious, they are increasingly seeking dietary supplements and functional foods that contain prebiotics. According to recent estimates, the market for digestive health products is projected to grow at a CAGR of approximately 8% over the next five years. This growth is indicative of a broader shift towards preventive healthcare, where consumers prioritize products that enhance their overall well-being. The prebiotics market is thus positioned to benefit from this increasing consumer focus on digestive health, as manufacturers innovate to meet the rising demand for effective and natural prebiotic solutions.

Government Initiatives Promoting Health Awareness

Government initiatives in China aimed at promoting health awareness are playing a crucial role in the growth of the prebiotics market. Various health campaigns and educational programs are being implemented to inform the public about the benefits of a balanced diet and the role of prebiotics in maintaining gut health. These initiatives are likely to foster a more informed consumer base that actively seeks out prebiotic products. Furthermore, the government's support for research and development in the health sector is expected to lead to innovations in prebiotic formulations. As a result, the prebiotics market is poised to benefit from increased consumer engagement and a more favorable regulatory environment that encourages the consumption of health-promoting products.