Government Policy and Regulation

Government policies and regulations play a crucial role in shaping the oil gas-projects market in China. The Chinese government has implemented various policies aimed at promoting energy independence and reducing reliance on foreign oil. For instance, the introduction of favorable tax incentives and subsidies for domestic oil and gas exploration has encouraged investment in the sector. Additionally, regulations aimed at environmental protection are influencing project development, pushing companies to adopt cleaner technologies. As a result, the oil gas-projects market is adapting to these regulatory frameworks, which could lead to increased investment in sustainable practices while still addressing the growing energy needs of the country.

Rising Domestic Demand for Energy

The increasing domestic demand for energy in China is a primary driver of the oil gas-projects market. As the economy continues to expand, energy consumption is projected to rise significantly. In 2025, China's energy consumption is expected to reach approximately 4.5 billion tons of standard coal equivalent. This surge in demand necessitates the development of new oil and gas projects to ensure energy security and meet the needs of various sectors, including manufacturing and transportation. The oil gas-projects market is likely to experience growth as companies invest in exploration and production to satisfy this demand, thereby enhancing energy supply stability.

Technological Innovations in Extraction

Technological innovations in extraction methods are significantly impacting the oil gas-projects market. Advances in hydraulic fracturing and horizontal drilling techniques have enhanced the efficiency of oil and gas extraction, allowing for the tapping of previously inaccessible reserves. In China, the adoption of these technologies is expected to increase production rates and reduce operational costs. For example, the implementation of advanced seismic imaging techniques has improved the accuracy of resource identification, leading to more successful drilling outcomes. This trend suggests that the oil gas-projects market will continue to evolve, driven by the need for more efficient and cost-effective extraction methods.

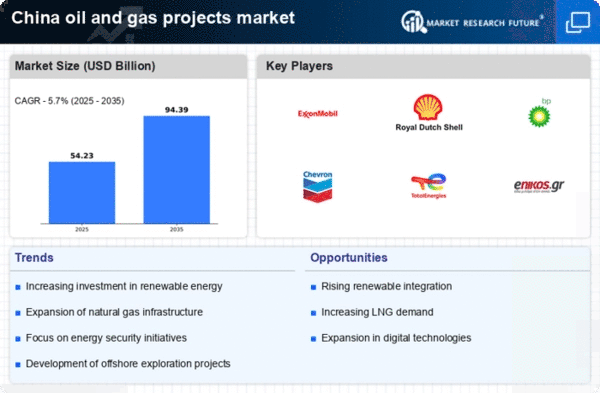

Investment in Renewable Energy Integration

The integration of renewable energy sources into the existing energy framework is emerging as a significant driver for the oil gas-projects market. As China aims to achieve its carbon neutrality goals by 2060, there is a growing emphasis on balancing fossil fuel use with renewable energy. Investments in hybrid projects that combine oil and gas with renewable sources, such as solar and wind, are becoming more prevalent. This shift not only diversifies the energy portfolio but also enhances the resilience of the oil gas-projects market against fluctuations in fossil fuel demand. The potential for synergy between traditional and renewable energy sources may lead to innovative project developments.

Geopolitical Factors and Supply Chain Dynamics

Geopolitical factors and supply chain dynamics are increasingly influencing the oil gas-projects market in China. The ongoing tensions in international relations can affect the availability and pricing of crude oil and natural gas imports. As a result, China is focusing on enhancing its domestic production capabilities to mitigate risks associated with external supply disruptions. The government is likely to prioritize investments in local oil and gas projects to bolster energy security. This strategic shift may lead to a more robust oil gas-projects market, as companies adapt to the changing geopolitical landscape and seek to ensure a stable energy supply for the nation.