Integration of Gamification in Learning

Gamification is emerging as a powerful driver within the micro learning market in China. By incorporating game-like elements into training programs, organizations are able to enhance engagement and motivation among learners. This trend is particularly appealing to younger employees who are accustomed to interactive and immersive experiences. The micro learning market is witnessing a rise in platforms that utilize gamification techniques, such as rewards, leaderboards, and challenges, to facilitate learning. Research suggests that gamified learning can increase retention rates by up to 50%, making it a compelling strategy for companies looking to maximize the impact of their training initiatives.

Government Initiatives Supporting E-Learning

The Chinese government is actively promoting e-learning initiatives, which significantly impacts the micro learning market. Policies aimed at enhancing digital education infrastructure and accessibility are fostering an environment conducive to the growth of micro learning solutions. Government funding and support for educational technology startups are also contributing to innovation within the micro learning market. As a result, organizations are increasingly leveraging these resources to develop and implement effective training programs. Recent reports indicate that government-backed e-learning initiatives could lead to a 20% increase in the adoption of micro learning solutions across various sectors, highlighting the potential for growth in this area.

Shift Towards Data-Driven Learning Analytics

The micro learning market in China is witnessing a shift towards data-driven learning analytics, which is transforming how organizations approach training. By utilizing data analytics, companies can gain insights into learner behavior, preferences, and performance. This information allows for the customization of learning experiences, making them more relevant and effective. The micro learning market is increasingly adopting analytics tools to track engagement and measure the impact of training programs. Studies indicate that organizations that leverage data analytics in their learning strategies can achieve a 25% increase in training effectiveness, emphasizing the importance of data in shaping future learning initiatives.

Increased Focus on Employee Skill Development

In the context of the micro learning market in China, there is a heightened emphasis on employee skill development. Companies are increasingly investing in training programs that enhance the skills of their workforce, particularly in technology and digital competencies. This focus is driven by the rapid pace of technological advancement and the need for employees to stay relevant in their roles. The micro learning market is responding to this demand by offering targeted learning modules that address specific skill gaps. Recent statistics indicate that organizations that implement micro learning strategies see a 30% improvement in employee performance, underscoring the effectiveness of this approach.

Rising Demand for Flexible Learning Solutions

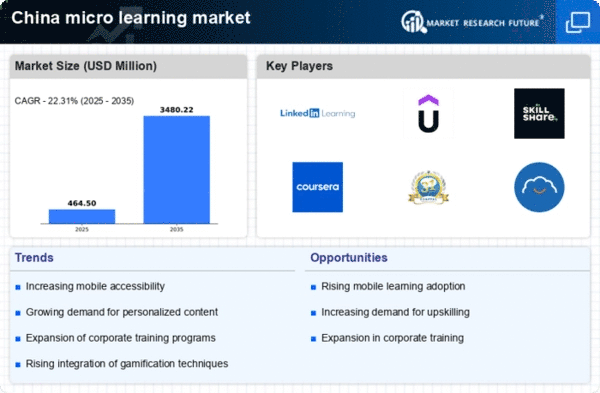

The micro learning market in China is experiencing a notable surge in demand for flexible learning solutions. As the workforce becomes increasingly mobile, employees seek training that fits into their busy schedules. This trend is reflected in the growing adoption of micro learning platforms, which allow for short, focused learning sessions that can be accessed anytime and anywhere. According to recent data, the market is projected to grow at a CAGR of approximately 15% over the next five years. This shift towards flexibility is reshaping the micro learning market, as organizations recognize the need to provide training that accommodates diverse learning preferences and lifestyles.