Increased Focus on Skill Development

In the context of the micro learning market, there is a growing emphasis on skill development among German organizations. As industries evolve and new technologies emerge, the need for continuous learning becomes paramount. Micro learning provides a targeted approach to skill acquisition, allowing employees to quickly grasp essential concepts and apply them in real-time. Reports indicate that around 60% of German firms prioritize upskilling their workforce, with micro learning modules being integrated into training programs. This focus on skill enhancement not only boosts employee performance but also positions organizations to remain competitive in a rapidly changing market landscape.

Integration of Gamification in Learning

The integration of gamification elements into the micro learning market is emerging as a compelling driver in Germany. By incorporating game-like features such as rewards, challenges, and interactive content, organizations are enhancing employee engagement and motivation in training programs. This approach not only makes learning more enjoyable but also fosters a competitive spirit among employees. Recent studies indicate that companies utilizing gamified micro learning experiences report a 30% increase in knowledge retention. As a result, the micro learning market is likely to expand as more organizations recognize the benefits of gamification in promoting effective learning outcomes.

Adoption of Mobile Learning Technologies

The micro learning market in Germany is significantly influenced by the widespread adoption of mobile learning technologies. With the proliferation of smartphones and tablets, employees are increasingly accessing training materials on-the-go. This trend aligns with the preferences of a mobile workforce that seeks convenient and efficient learning solutions. Data suggests that over 50% of German employees prefer mobile learning options, which has prompted organizations to invest in micro learning platforms that are mobile-friendly. Consequently, this shift towards mobile accessibility is likely to drive the growth of the micro learning market, as companies strive to meet the evolving needs of their workforce.

Rising Demand for Flexible Learning Solutions

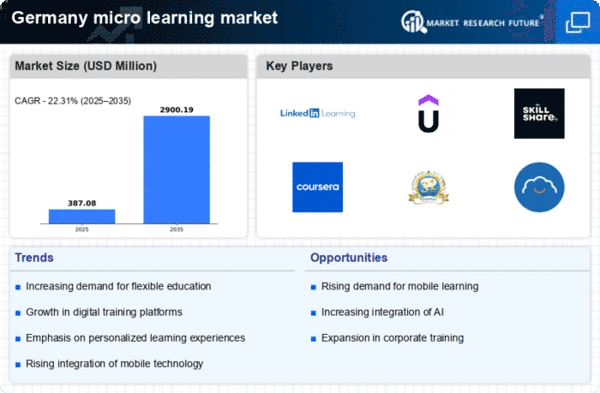

The micro learning market in Germany is experiencing a notable surge in demand for flexible learning solutions. As organizations increasingly recognize the need for adaptable training methods, micro learning offers a viable alternative to traditional learning approaches. This shift is driven by the desire for on-demand content that can be accessed anytime and anywhere, catering to the diverse needs of employees. Recent data indicates that approximately 70% of German companies are investing in digital learning solutions, with micro learning being a key focus area. This trend suggests that the micro learning market is poised for growth as businesses seek to enhance workforce productivity and engagement through tailored learning experiences.

Growing Importance of Data-Driven Learning Analytics

In the micro learning market, the growing importance of data-driven learning analytics is shaping the way organizations approach training and development in Germany. By leveraging analytics, companies can gain insights into employee performance, learning preferences, and content effectiveness. This data-driven approach enables organizations to tailor micro learning experiences to meet specific needs, ultimately enhancing training outcomes. Approximately 65% of German businesses are now utilizing learning analytics to inform their training strategies. This trend indicates that the micro learning market is evolving towards a more personalized and effective learning environment, driven by the insights gained from data analysis.