in February 2022, the innovative learning platform, Realizeit, publicly shared its plans for the future, focusing on the introduction of knowledge retention tools for employees through automatized micro learning. Such content is necessary in cases where targeted knowledge and/or skills need to be reinforced through training.

In September 2022, A new feature that was recently introduced is ‘Clips’, which has enabled employees to access minute long clips. Coursera began with quarter million short learning videos which offer skills that are in high demand and can be learned in less than ten minutes.

In April 2023, zick learn, a company founded in Dublin, Ireland, was able to solicit €500,000 to further its learning model across the European region. Leadership was provided by zanichelli Venture, an investment firm; in addition, other private investors made contributions to the funding round.

In June 2023, Paycor, which specializes in human resources and capital management software, announced the buyout of Verb, a micro-learning platform based on behavioral science principles. The purpose of this acquisition is in line with the vision of Paycor, which is to enable leaders to bring about positive behavior change through structured development pathways.

In August 2023, Valamis, one of the global pioneers in the digital learning technologies and workforce development domain, announced entering into a new strategic partnership with iAM Learning, a reputable eLearning destination known for its engaging learning content. iAM focuses on creating short, high-quality quality, unique, and engaging learning experiences; iAM Learning utilizes excellent animation, rich storytelling, and interesting characters as the primary means of making learning enjoyable.

In September 2023, Axonify, a frontline employee enablement player and registered zebra ISV partner, has extended its work with zebra technologies. In addition, as part of the initial co-sale of the associates, comprising these software solutions offered by zebra, Axonify also delivers.

The Global Micro-Learning Market has recently seen important developments. Companies like EdApp and Axonify continue to innovate their platforms, enhancing user engagement through bite-sized content tailored for quick consumption. Coursera has expanded its course offerings in partnership with universities, while Duolingo reports significant user growth, further solidifying its presence in the education tech space. TalentLMS and LinkedIn Learning are focusing on improving user experience through advanced analytics and personalized learning paths.Regarding mergers and acquisitions, there have been no widely publicized recent transactions involving key players such as Udemy, Skillshare, or Khan Academy.

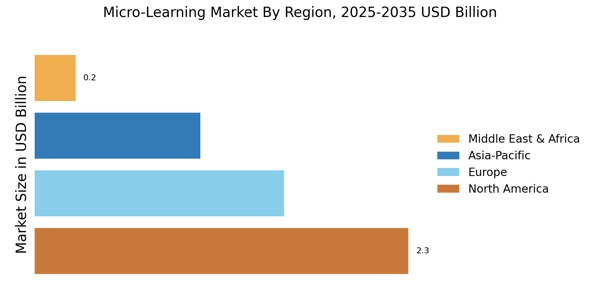

However, the overall growth in market valuation for companies like Pluralsight and Alison indicates a positive trend and increased investment interest in micro-learning solutions. This growth is encouraging companies in the sector to enhance their offerings and explore potential collaborations for future expansion. The micro-learning segment is adapting rapidly to the demands of remote education, contributing significantly to the growth of the overall online learning ecosystem, making it a critical area to watch as it evolves.