Aging Population

The aging population in China is a critical driver of the China medical device market. As the demographic shifts towards an older age group, the demand for medical devices, particularly those related to chronic diseases and geriatric care, is expected to rise. By 2025, it is projected that over 300 million individuals in China will be aged 60 and above, significantly increasing the need for advanced medical technologies. This demographic trend compels healthcare providers to invest in innovative medical devices that cater to the specific needs of older patients, thereby propelling growth in the china medical device market. Furthermore, the government has recognized this trend and is likely to implement policies that support the development and distribution of medical devices tailored for elderly care.

Rising Health Awareness

Rising health awareness among the Chinese population is significantly influencing the China medical device market. As individuals become more conscious of their health and wellness, there is an increasing demand for medical devices that promote preventive care and early diagnosis. This trend is reflected in the growing sales of home healthcare devices, such as blood pressure monitors and glucose meters, which have seen a surge in popularity. According to recent statistics, the market for home healthcare devices in China is expected to reach USD 10 billion by 2026. This heightened awareness is likely to drive innovation and investment in the china medical device market, as manufacturers strive to meet the evolving needs of health-conscious consumers.

Technological Innovations

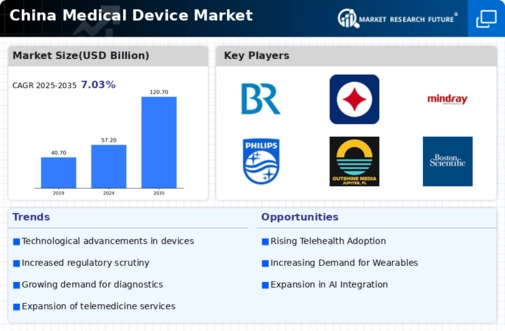

Technological innovations are transforming the landscape of the China medical device market. The integration of advanced technologies such as artificial intelligence, telemedicine, and wearable devices is revolutionizing patient care and diagnostics. For instance, AI-powered diagnostic tools are enhancing the accuracy and speed of disease detection, while telemedicine platforms are expanding access to healthcare services in remote areas. The market for wearable health devices is projected to grow at a compound annual growth rate of over 20% in the next five years, indicating a robust demand for innovative solutions. These technological advancements not only improve patient outcomes but also create new opportunities for growth within the china medical device market.

Government Initiatives and Funding

Government initiatives and funding play a pivotal role in shaping the China medical device market. The Chinese government has been actively promoting the development of the healthcare sector through various policies and financial support mechanisms. For instance, the 'Healthy China 2030' initiative aims to enhance healthcare services and improve access to medical devices across the nation. In 2021, the government allocated substantial funding to support research and development in medical technologies, which is expected to continue in the coming years. This financial backing not only encourages innovation but also facilitates the entry of new players into the china medical device market, fostering a competitive landscape that benefits consumers and healthcare providers alike.

Increasing Investment in Healthcare Infrastructure

Increasing investment in healthcare infrastructure is a significant driver of the China medical device market. The Chinese government has been prioritizing the enhancement of healthcare facilities, particularly in underserved regions. This investment includes the construction of new hospitals and clinics, as well as the upgrading of existing medical facilities. According to recent reports, healthcare expenditure in China is expected to reach USD 1 trillion by 2025, which will likely lead to a surge in demand for medical devices. As healthcare infrastructure improves, the accessibility and availability of medical devices will increase, thereby stimulating growth in the china medical device market. This trend suggests a promising future for manufacturers and suppliers operating within this dynamic sector.