Surge in Renewable Energy Storage

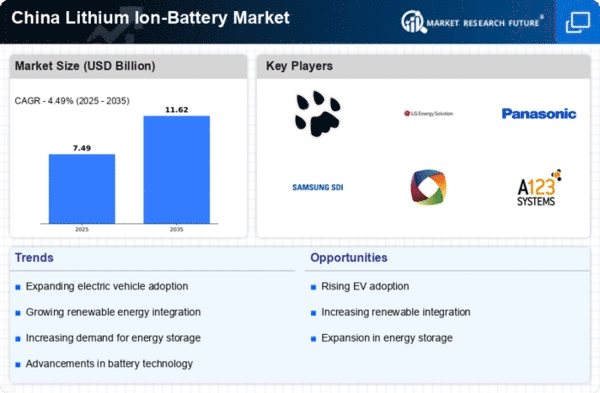

The lithium ion-battery market is experiencing a notable surge in demand due to the increasing reliance on renewable energy sources in China. As the country aims to enhance its energy security and reduce carbon emissions, the integration of lithium ion batteries for energy storage solutions becomes crucial. In 2025, the installed capacity of renewable energy in China is projected to reach approximately 1,200 GW, necessitating efficient storage systems. Lithium ion batteries are favored for their high energy density and efficiency, making them ideal for storing energy generated from solar and wind sources. This trend not only supports the transition to a greener energy landscape but also propels the growth of the lithium ion-battery market, as investments in energy storage technologies are expected to rise significantly.

Government Incentives and Policies

The lithium ion-battery market is significantly influenced by supportive government policies and incentives in China. The Chinese government has implemented various initiatives aimed at promoting the adoption of electric vehicles (EVs) and renewable energy technologies. For instance, subsidies for EV purchases and investments in battery manufacturing facilities are designed to stimulate market growth. In 2025, it is estimated that government incentives could account for up to 30% of the total market value of lithium ion batteries in the country. These policies not only encourage manufacturers to innovate but also enhance consumer acceptance of lithium ion battery technologies, thereby driving the overall market forward.

Rising Consumer Electronics Demand

The rising demand for consumer electronics in China is a significant driver of the lithium ion-battery market. With the proliferation of smartphones, laptops, and other portable devices, the need for efficient and reliable battery solutions is paramount. In 2025, the consumer electronics sector is expected to account for nearly 40% of the total lithium ion-battery market share. This trend underscores the importance of lithium ion batteries, which are favored for their lightweight and high energy density characteristics. As manufacturers continue to innovate and enhance battery performance, the market is likely to witness sustained growth, driven by the insatiable appetite for advanced consumer electronics.

Expansion of Electric Vehicle Infrastructure

The expansion of electric vehicle infrastructure in China is a critical driver for the lithium ion-battery market. As the country continues to invest heavily in charging stations and related facilities, the demand for lithium ion batteries is expected to rise correspondingly. By 2025, the number of public charging stations is projected to exceed 1 million, creating a robust ecosystem for electric vehicles. This infrastructure development not only facilitates the adoption of EVs but also enhances the market for lithium ion batteries, as they are the primary power source for these vehicles. The synergy between infrastructure and battery technology is likely to propel the market to new heights.

Technological Innovations in Battery Production

Technological innovations in battery production are reshaping the lithium ion-battery market in China. Advances in manufacturing processes, such as automation and improved materials, are enhancing the efficiency and reducing the costs associated with battery production. In 2025, it is anticipated that the cost of lithium ion batteries will decrease by approximately 20%, making them more accessible for various applications. These innovations not only improve the performance of batteries but also contribute to the overall growth of the market, as manufacturers strive to meet the increasing demand from sectors such as consumer electronics and electric vehicles.