Adoption of Cloud-Based Solutions

The shift towards cloud-based solutions is transforming the landscape of the China laboratory information management systems market. Laboratories are increasingly recognizing the benefits of cloud technology, including scalability, cost-effectiveness, and enhanced collaboration. Cloud-based laboratory information management systems allow for real-time data access and sharing among teams, regardless of geographical location. This trend is particularly relevant in the context of China's rapidly evolving technological landscape, where digital transformation is a key priority. As organizations seek to optimize their operations and reduce IT overhead, the adoption of cloud-based systems is expected to accelerate. This transition not only improves operational efficiency but also supports the growing trend of remote work in laboratory settings.

Growing Demand for Data Management

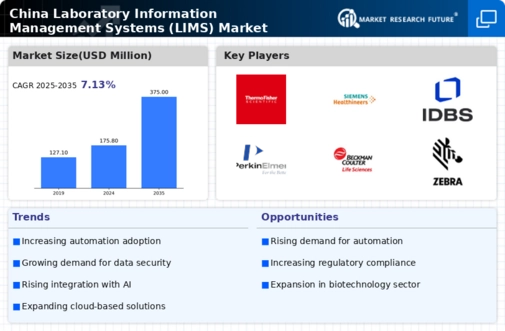

The increasing complexity of laboratory operations in China has led to a growing demand for efficient data management solutions. Laboratories are generating vast amounts of data, necessitating robust systems to manage, analyze, and store this information. The China laboratory information management systems market is witnessing a surge in demand as organizations seek to enhance their operational efficiency and data integrity. According to recent statistics, the market is projected to grow at a compound annual growth rate of approximately 12% over the next five years. This growth is driven by the need for improved data accessibility and the ability to make informed decisions based on real-time data analysis. As laboratories strive to maintain competitiveness, the adoption of advanced laboratory information management systems becomes increasingly critical.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) into laboratory information management systems is reshaping the China laboratory information management systems market. These technologies enable laboratories to automate routine tasks, enhance data analysis, and improve decision-making processes. The application of AI and ML can lead to significant time savings and increased accuracy in laboratory operations. As laboratories strive to leverage data for competitive advantage, the demand for systems that incorporate these advanced technologies is likely to rise. Furthermore, the ability to analyze large datasets and derive actionable insights is becoming increasingly critical in various sectors, including healthcare and environmental monitoring. This trend indicates a promising future for the integration of advanced technologies within laboratory information management systems.

Regulatory Compliance and Quality Assurance

In the context of the China laboratory information management systems market, regulatory compliance is paramount. Laboratories are required to adhere to stringent regulations set forth by governmental bodies, which necessitates the implementation of comprehensive data management systems. These systems facilitate compliance with standards such as Good Laboratory Practice (GLP) and ISO certifications. The increasing focus on quality assurance in laboratory processes has prompted organizations to invest in laboratory information management systems that ensure traceability and accountability of data. As regulatory scrutiny intensifies, the demand for systems that can streamline compliance processes is expected to rise, further propelling the growth of the market. This trend underscores the importance of integrating compliance features into laboratory information management systems.

Rising Investment in Research and Development

China's commitment to advancing its scientific research capabilities is reflected in the substantial investments being made in research and development (R&D). The government has prioritized innovation, leading to an increase in funding for laboratories across various sectors, including pharmaceuticals, biotechnology, and environmental science. This influx of investment is driving the growth of the China laboratory information management systems market, as laboratories seek to modernize their operations and enhance data management capabilities. Enhanced R&D activities necessitate sophisticated laboratory information management systems that can support complex workflows and facilitate collaboration among researchers. As the focus on innovation continues, the demand for advanced data management solutions is likely to expand, positioning the market for sustained growth.