Increased Focus on Data Analytics

The laboratory informatics market is shifting towards data analytics due to the need for actionable insights in research and development. As laboratories generate vast amounts of data, the ability to analyze and interpret this information becomes critical. Organizations are increasingly investing in informatics solutions that offer advanced analytics capabilities, enabling them to derive meaningful conclusions from complex datasets. This trend is particularly evident in sectors such as healthcare and environmental science, where data-driven decision-making is essential. By 2025, it is projected that the analytics segment will represent a significant portion of the laboratory informatics market, reflecting the growing recognition of data as a valuable asset.

Emergence of Personalized Medicine

The laboratory informatics market is being shaped by the emergence of personalized medicine. As healthcare shifts towards more individualized treatment approaches, laboratories are required to adopt informatics solutions that can handle diverse data types, including genomic and proteomic information. This transition necessitates sophisticated data management systems capable of integrating and analyzing complex biological data. The market is expected to expand as healthcare providers seek to implement personalized treatment plans, with investments in informatics solutions projected to increase by 15% annually. This driver highlights the critical role of laboratory informatics in supporting the future of healthcare in China.

Government Initiatives and Funding

Government initiatives in China are playing a crucial role in propelling the laboratory informatics market forward. With a commitment to enhancing the country's research infrastructure, the government has allocated substantial funding towards the development of laboratory technologies. In recent years, investments have exceeded $1 billion, aimed at fostering innovation and improving laboratory efficiency. These initiatives not only support the acquisition of advanced informatics solutions but also encourage collaboration between public and private sectors. As a result, the laboratory informatics market is likely to benefit from increased funding and resources, which will facilitate the adoption of cutting-edge technologies and improve overall research outcomes.

Growing Emphasis on Regulatory Compliance

The laboratory informatics market is significantly influenced by the growing emphasis on regulatory compliance within China. As industries such as pharmaceuticals and food safety face stringent regulations, laboratories are compelled to adopt informatics solutions that ensure adherence to these standards. The need for accurate data management and reporting is paramount, as non-compliance can lead to severe penalties. Consequently, There is a shift towards systems that enhance traceability and data integrity in the market. In 2025, it is estimated that compliance-related investments will account for approximately 30% of the total laboratory informatics market expenditure, underscoring the importance of regulatory adherence in shaping market dynamics.

Rising Demand for Advanced Research Capabilities

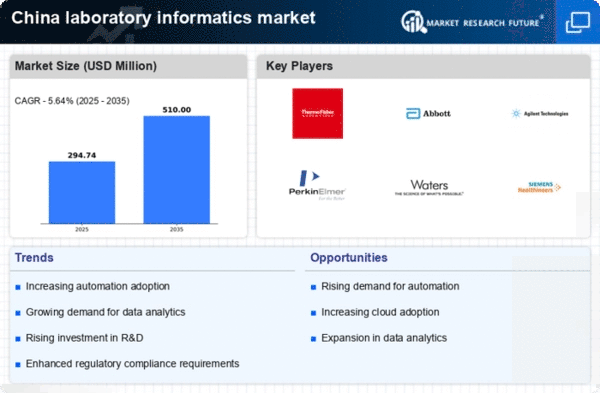

The laboratory informatics market in China is experiencing a notable surge in demand for advanced research capabilities. This trend is largely driven by the increasing focus on innovation in various sectors, including pharmaceuticals and biotechnology. As research institutions and laboratories strive to enhance their operational efficiency, the adoption of sophisticated informatics solutions becomes essential. In 2025, the market is projected to grow at a CAGR of approximately 12%, reflecting the urgency for tools that facilitate complex data analysis and management. The integration of advanced informatics systems allows researchers to streamline workflows and accelerate scientific discovery. Consequently, this driver is pivotal in shaping the landscape of the laboratory informatics market.