Increased Focus on Automation

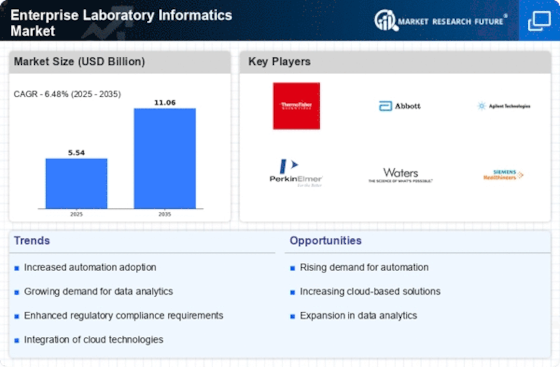

Automation in laboratory processes is becoming increasingly critical, significantly impacting the Enterprise Laboratory Informatics Market. The integration of automated systems reduces human error, enhances reproducibility, and accelerates workflows. As laboratories strive for higher efficiency, the automation of routine tasks is expected to grow, with a projected increase in the adoption of laboratory informatics solutions that support automation. This trend is reflected in the anticipated market growth, with estimates suggesting a rise to USD 5 billion by 2026. The shift towards automation not only streamlines operations but also allows laboratory personnel to focus on more complex tasks, thereby enhancing overall productivity within the Enterprise Laboratory Informatics Market.

Emergence of Personalized Medicine

The shift towards personalized medicine is significantly influencing the Enterprise Laboratory Informatics Market. As healthcare moves towards tailored treatments based on individual patient profiles, laboratories are increasingly required to analyze diverse data types, including genomic and proteomic information. This trend necessitates the adoption of informatics solutions that can integrate and interpret complex datasets effectively. The market is projected to grow, with estimates indicating a value of USD 5 billion by 2026, driven by the need for advanced informatics systems that support personalized medicine initiatives. As laboratories adapt to this evolving landscape, the Enterprise Laboratory Informatics Market is likely to experience substantial growth.

Advancements in Analytical Technologies

The rapid advancements in analytical technologies are reshaping the landscape of the Enterprise Laboratory Informatics Market. Innovations in areas such as mass spectrometry, chromatography, and molecular diagnostics are driving the need for sophisticated informatics solutions that can manage and analyze complex data sets. As laboratories adopt these advanced technologies, the demand for integrated informatics systems that can seamlessly handle data from various sources is increasing. This trend is expected to propel market growth, with estimates suggesting a rise to USD 5 billion by 2026. The integration of cutting-edge analytical technologies with informatics solutions enhances data accuracy and supports informed decision-making within the Enterprise Laboratory Informatics Market.

Rising Demand for Data Management Solutions

The increasing complexity of laboratory operations necessitates robust data management solutions, driving growth in the Enterprise Laboratory Informatics Market. Laboratories are generating vast amounts of data, and the need for efficient data handling and analysis is paramount. According to recent estimates, the market for laboratory informatics is projected to reach USD 5 billion by 2026, reflecting a compound annual growth rate of approximately 8%. This demand is fueled by the need for improved operational efficiency and the ability to derive actionable insights from data. As laboratories seek to enhance their productivity and accuracy, the adoption of advanced informatics solutions becomes essential, thereby propelling the Enterprise Laboratory Informatics Market forward.

Growing Need for Compliance and Quality Control

Regulatory compliance and quality control are paramount in laboratory settings, driving the demand for informatics solutions within the Enterprise Laboratory Informatics Market. Laboratories must adhere to stringent regulations, which necessitate the implementation of systems that ensure data integrity and traceability. The market is witnessing a surge in the adoption of informatics solutions that facilitate compliance with regulatory standards, such as Good Laboratory Practice (GLP) and ISO certifications. This trend is expected to contribute to the market's growth, with projections indicating a market value of USD 5 billion by 2026. As laboratories prioritize compliance and quality assurance, the Enterprise Laboratory Informatics Market is likely to expand in response to these needs.