Government Initiatives and Support

The Chinese government plays a pivotal role in fostering the industrial analytics market through various initiatives and support programs. Policies aimed at promoting digital transformation and smart manufacturing are likely to catalyze growth in this sector. For instance, the government has allocated substantial funding, estimated at $10 billion, to support the development of advanced analytics technologies. This financial backing encourages innovation and adoption of analytics solutions across industries. Consequently, the industrial analytics market is expected to thrive as businesses align with national strategies that prioritize data analytics as a cornerstone of industrial advancement.

Growing Focus on Operational Efficiency

The pursuit of operational efficiency remains a central focus for industries in China, driving the industrial analytics market forward. Companies are increasingly adopting analytics tools to identify inefficiencies and streamline operations. In 2025, it is estimated that organizations utilizing analytics can achieve cost reductions of up to 20%. This focus on efficiency is particularly pronounced in sectors such as logistics and manufacturing, where data analytics can lead to significant improvements in resource allocation and process optimization. The industrial analytics market is thus likely to expand as businesses prioritize analytics to enhance their operational frameworks.

Increased Investment in Smart Manufacturing

Investment in smart manufacturing technologies is a key driver for the industrial analytics market in China. As companies transition towards automation and digitalization, the integration of analytics becomes essential for optimizing production processes. In 2025, the smart manufacturing sector is anticipated to reach a valuation of $200 billion, with a significant portion allocated to analytics solutions. This trend indicates a growing recognition of the importance of data analytics in enhancing productivity and quality control. The industrial analytics market stands to gain from this investment wave, as organizations seek to harness data for improved operational outcomes.

Emergence of Advanced Analytics Technologies

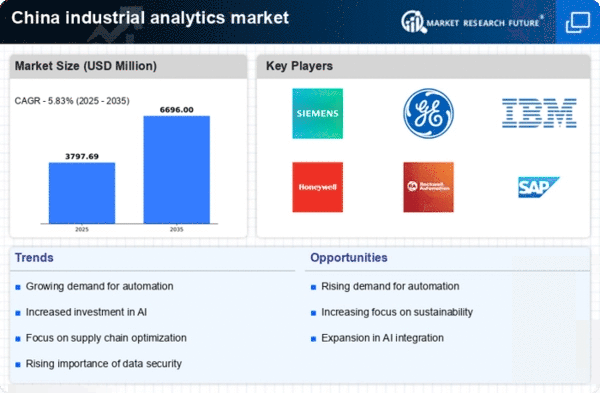

The emergence of advanced analytics technologies, including predictive and prescriptive analytics, is reshaping the industrial analytics market in China. These technologies enable organizations to not only analyze historical data but also forecast future trends and prescribe optimal actions. As industries increasingly adopt these sophisticated tools, the market is projected to grow at a CAGR of 18% through 2025. This growth is indicative of a broader shift towards data-centric decision-making processes. The industrial analytics market is poised to benefit from this technological evolution, as companies seek to leverage advanced analytics for competitive differentiation.

Rising Demand for Data-Driven Decision Making

The industrial analytics market in China experiences a notable surge in demand for data-driven decision making. As industries increasingly recognize the value of data insights, organizations are investing in analytics solutions to enhance operational efficiency and competitiveness. In 2025, the market is projected to grow by approximately 15%, driven by the need for real-time analytics and predictive modeling. This trend is particularly evident in manufacturing and supply chain sectors, where data analytics enables companies to optimize processes and reduce costs. The industrial analytics market is thus positioned to benefit from this growing emphasis on data utilization, as businesses seek to leverage analytics for strategic advantages.