Rising Geriatric Population

The increasing geriatric population in China is a significant factor influencing the hematology diagnostics market. As individuals age, the risk of developing hematological disorders escalates, necessitating regular diagnostic assessments. By 2030, it is projected that over 300 million people in China will be aged 60 and above, creating a substantial demand for hematology diagnostics. This demographic shift is prompting healthcare providers to enhance their diagnostic capabilities to cater to the needs of older patients. Consequently, the hematology diagnostics market is likely to experience robust growth, as healthcare systems adapt to the challenges posed by an aging population.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in China are significantly impacting the hematology diagnostics market. Increased funding for healthcare services, particularly in rural areas, is facilitating access to diagnostic tools and technologies. The Chinese government has allocated substantial resources to enhance laboratory capabilities and promote early detection of blood disorders. This investment is likely to result in a more robust healthcare system, ultimately driving the demand for hematology diagnostics. As a result, the market is projected to expand, with an anticipated growth rate of around 10% annually over the next five years, reflecting the government's commitment to improving public health.

Advancements in Diagnostic Technologies

Technological innovations in diagnostic equipment are transforming the hematology diagnostics market. The introduction of automated analyzers and point-of-care testing devices is enhancing the efficiency and accuracy of blood tests. These advancements allow for quicker turnaround times and improved patient management. In China, the market for hematology analyzers is expected to reach approximately $1 billion by 2026, driven by the demand for high-throughput testing solutions. Furthermore, the integration of artificial intelligence in diagnostic processes is likely to optimize results and reduce human error, thereby fostering growth in the hematology diagnostics market.

Growing Demand for Personalized Medicine

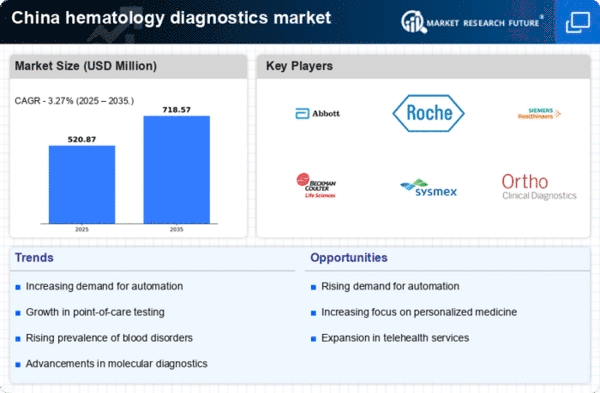

The trend towards personalized medicine is reshaping the hematology diagnostics market in China. As healthcare providers increasingly focus on tailored treatment plans based on individual patient profiles, the need for precise diagnostic tools becomes paramount. Advances in genomics and molecular diagnostics are enabling healthcare professionals to identify specific blood disorders and customize therapies accordingly. This shift is expected to drive the hematology diagnostics market, as more laboratories adopt advanced testing methodologies. The market is projected to grow at a compound annual growth rate (CAGR) of around 12% over the next five years, reflecting the increasing emphasis on personalized healthcare solutions.

Increasing Prevalence of Hematological Disorders

The rising incidence of hematological disorders in China is a crucial driver for the hematology diagnostics market. Conditions such as anemia, leukemia, and thrombocytopenia are becoming more prevalent, leading to a heightened demand for diagnostic testing. According to recent health statistics, approximately 15% of the population is affected by some form of blood disorder, which necessitates regular monitoring and diagnosis. This trend is likely to propel the market forward, as healthcare providers seek advanced diagnostic solutions to manage these conditions effectively. The hematology diagnostics market is expected to grow significantly as hospitals and laboratories invest in state-of-the-art technologies to enhance diagnostic accuracy and patient outcomes.