Government Policies and Regulations

The China green ammonia market is significantly influenced by government policies aimed at reducing carbon emissions and promoting sustainable energy sources. The Chinese government has set ambitious targets to achieve carbon neutrality by 2060, which has led to the implementation of various incentives for green ammonia production. For instance, subsidies and tax breaks are provided to companies investing in renewable energy technologies. In 2023, the government announced a plan to increase the share of renewable energy in the national energy mix to 50% by 2030, which is expected to bolster the green ammonia market. Furthermore, regulations mandating lower emissions in industrial processes are likely to drive demand for green ammonia as a cleaner alternative to traditional ammonia production methods.

Technological Innovations in Production

Technological advancements play a crucial role in the growth of the China green ammonia market. Innovations in electrolysis and Haber-Bosch processes have made it feasible to produce ammonia using renewable energy sources, thereby reducing reliance on fossil fuels. In 2025, several Chinese companies reported a 30% increase in production efficiency due to the adoption of advanced catalysts and optimized production techniques. These innovations not only lower production costs but also enhance the overall sustainability of ammonia production. As technology continues to evolve, it is anticipated that the cost of green ammonia will decrease, making it more competitive with conventional ammonia. This trend is likely to attract more investments into the green ammonia sector, further stimulating market growth.

Global Market Trends and Export Opportunities

The China green ammonia market is poised to benefit from global market trends and export opportunities. As countries worldwide strive to meet their climate commitments, the demand for green ammonia is expected to rise. In 2025, China emerged as one of the leading producers of green ammonia, with a production capacity of over 2 million tons per year. This positions China favorably in the global market, allowing it to export green ammonia to regions with high demand, such as Europe and Japan. The potential for international trade in green ammonia could further stimulate domestic production and innovation. Additionally, partnerships with foreign companies may facilitate technology transfer and enhance the competitiveness of the Chinese green ammonia market.

Investment in Renewable Energy Infrastructure

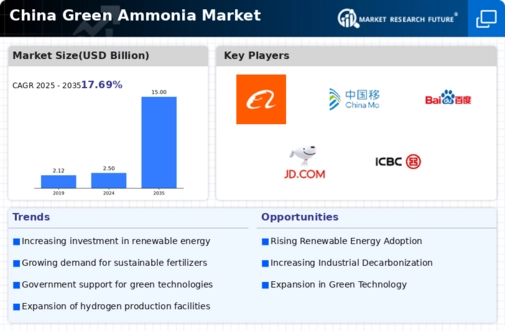

Investment in renewable energy infrastructure is a significant driver of the China green ammonia market. The Chinese government has committed substantial resources to develop solar, wind, and hydropower projects, which are essential for producing green ammonia. In 2024, investments in renewable energy reached over USD 100 billion, with a portion allocated specifically for green hydrogen and ammonia projects. This influx of capital is expected to enhance the production capacity of green ammonia facilities across the country. As renewable energy sources become more prevalent, the cost of producing green ammonia is likely to decrease, making it a more attractive option for various applications. The synergy between renewable energy and green ammonia production is anticipated to create a robust market environment.

Rising Industrial Demand for Sustainable Solutions

The demand for green ammonia in various industrial sectors is a key driver for the China green ammonia market. Industries such as agriculture, energy, and transportation are increasingly seeking sustainable alternatives to traditional ammonia. In 2025, the agricultural sector accounted for approximately 60% of ammonia consumption in China, with a growing preference for green ammonia due to its lower environmental impact. Additionally, the energy sector is exploring green ammonia as a potential hydrogen carrier, which could facilitate the transition to a hydrogen economy. The increasing awareness of environmental issues among consumers and businesses is likely to propel the demand for green ammonia, as industries strive to meet sustainability goals and comply with stricter regulations.