Increased Government Investment

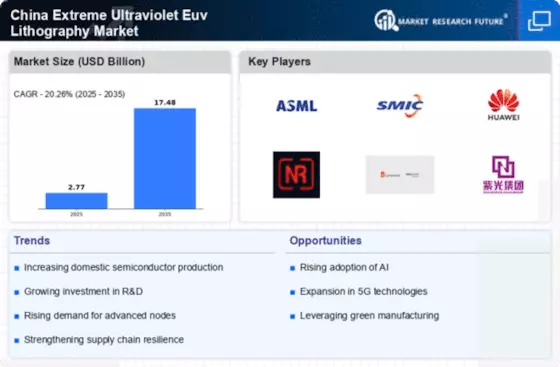

The China Extreme Ultraviolet Euv Lithography Market is experiencing a surge in government investment aimed at bolstering domestic semiconductor manufacturing capabilities. The Chinese government has allocated substantial funds to support research and development in advanced lithography technologies. This financial backing is crucial as it enables local companies to enhance their technological prowess and reduce reliance on foreign suppliers. In 2025, the government announced a multi-billion dollar initiative to promote the development of EUV lithography systems, which is expected to significantly boost production capacity. As a result, the market is likely to witness accelerated growth, with projections indicating a compound annual growth rate (CAGR) of over 15% through 2030. This investment not only strengthens the domestic supply chain but also positions China as a formidable player in the global semiconductor landscape.

Strategic Collaborations and Partnerships

The China Extreme Ultraviolet Euv Lithography Market is witnessing a trend of strategic collaborations and partnerships among domestic and international firms. These alliances are formed to leverage complementary strengths, share technological expertise, and accelerate the development of EUV lithography systems. For instance, several Chinese semiconductor manufacturers have entered into partnerships with leading global technology firms to enhance their capabilities in EUV lithography. Such collaborations not only facilitate knowledge transfer but also enable access to advanced technologies that may not be readily available domestically. As a result, the market is likely to benefit from improved innovation and faster time-to-market for new products. This collaborative approach is expected to foster a more robust ecosystem for Euv lithography in China, ultimately contributing to the growth of the industry.

Technological Advancements in Lithography

Technological advancements in lithography are significantly impacting the China Extreme Ultraviolet Euv Lithography Market. Innovations in EUV lithography technology are enabling manufacturers to produce smaller and more complex semiconductor devices with higher precision. In 2025, advancements in Euv light sources and optics have led to improved resolution and throughput, making Euv lithography more viable for mass production. These developments are crucial as they allow Chinese semiconductor manufacturers to compete effectively on a global scale. Furthermore, the continuous evolution of lithography technology is expected to drive investment in research and development, fostering a culture of innovation within the industry. As a result, the market is likely to experience sustained growth, with companies striving to adopt the latest technologies to enhance their production capabilities.

Rising Focus on Domestic Semiconductor Production

The rising focus on domestic semiconductor production is a key driver for the China Extreme Ultraviolet Euv Lithography Market. In light of global supply chain disruptions and geopolitical tensions, there is an increasing emphasis on self-sufficiency in semiconductor manufacturing. The Chinese government has implemented policies to encourage local production, aiming to reduce dependence on foreign technology and components. In 2025, initiatives were launched to establish domestic EUV lithography production facilities, which are expected to enhance the country's manufacturing capabilities. This shift towards local production not only strengthens the domestic supply chain but also creates opportunities for growth within the Euv lithography market. As companies invest in building local capabilities, the market is likely to expand, driven by the need for reliable and advanced semiconductor manufacturing solutions.

Growing Demand for High-Performance Semiconductors

The demand for high-performance semiconductors in China is driving the growth of the Extreme Ultraviolet Euv Lithography Market. With the rapid advancement of technologies such as artificial intelligence, 5G, and the Internet of Things, there is an increasing need for chips that can handle complex computations and data processing. In 2025, the semiconductor market in China was valued at approximately USD 150 billion, with EUV lithography playing a pivotal role in producing smaller, more efficient chips. This trend is expected to continue, as industries increasingly adopt advanced technologies that require cutting-edge semiconductor solutions. Consequently, the EUV lithography market is poised for expansion, as manufacturers strive to meet the escalating demand for high-performance chips, thereby enhancing their competitive edge in the global market.