Rising Demand for Advanced Electronics

The UK Extreme Ultraviolet Euv Lithography Market is driven by the escalating demand for advanced electronics, including smartphones, tablets, and IoT devices. As consumer preferences shift towards more sophisticated and feature-rich products, semiconductor manufacturers are compelled to adopt EUV lithography techniques to meet these requirements. The market for advanced electronics in the UK is projected to reach 50 billion GBP by 2027, creating a substantial opportunity for Euv lithography technologies. This demand is further fueled by the increasing integration of artificial intelligence and 5G technology in electronic devices, necessitating the production of smaller and more efficient chips. Consequently, the UK semiconductor industry is likely to expand its capabilities in Euv lithography to cater to this growing market.

Technological Advancements in Lithography

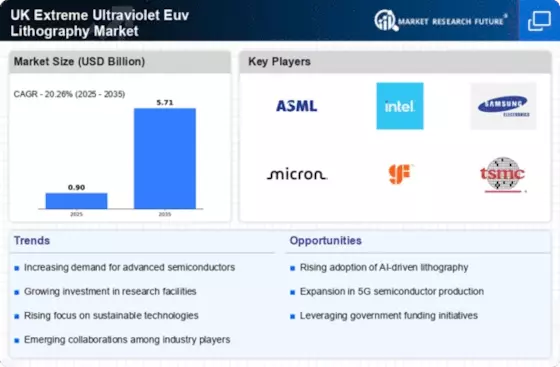

The UK Extreme Ultraviolet Euv Lithography Market is experiencing a surge in technological advancements that enhance the precision and efficiency of semiconductor manufacturing. Innovations in EUV lithography systems, such as improved light sources and optics, are enabling the production of smaller and more complex chips. This is particularly relevant as the UK aims to bolster its semiconductor capabilities, with the market projected to grow at a compound annual growth rate of 15% over the next five years. The integration of artificial intelligence and machine learning in lithography processes is also streamlining operations, reducing costs, and increasing yield rates. As a result, the UK is positioning itself as a competitive player in the global semiconductor landscape, attracting investments and fostering collaborations among industry stakeholders.

Sustainability in Semiconductor Manufacturing

Sustainability is becoming a pivotal focus within the UK Extreme Ultraviolet Euv Lithography Market, as manufacturers seek to minimize their environmental impact. The adoption of EUV lithography is seen as a more sustainable alternative to traditional lithography methods, as it requires fewer processing steps and reduces material waste. Furthermore, UK semiconductor firms are increasingly investing in green technologies and practices, aligning with the government's commitment to achieving net-zero carbon emissions by 2050. This shift towards sustainability not only enhances the reputation of the UK semiconductor industry but also attracts environmentally conscious investors. As a result, the market is likely to witness a growing demand for Euv lithography solutions that prioritize eco-friendly practices.

Collaboration and Partnerships in the Industry

Collaboration and partnerships are emerging as key drivers within the UK Extreme Ultraviolet Euv Lithography Market. As the complexity of semiconductor manufacturing increases, companies are recognizing the need to work together to share knowledge, resources, and technology. Strategic alliances between UK semiconductor firms and international players are fostering innovation in EUV lithography processes. For instance, partnerships with research institutions and universities are enhancing R&D efforts, leading to breakthroughs in lithography technologies. This collaborative approach is expected to accelerate the development and commercialization of advanced Euv lithography systems, positioning the UK as a leader in The Extreme Ultraviolet Euv Lithography. Such synergies are likely to enhance the overall competitiveness of the UK semiconductor industry.

Government Support for Semiconductor Innovation

The UK government is actively promoting the growth of the Extreme Ultraviolet Euv Lithography Market through various initiatives and funding programs. The UK Semiconductor Strategy, launched in 2022, aims to enhance the country's semiconductor ecosystem by investing in research and development, infrastructure, and workforce training. This strategic support is expected to drive innovation in EUV lithography technologies, making the UK a hub for semiconductor manufacturing. With an estimated investment of 1 billion GBP over the next five years, the government is incentivizing companies to adopt advanced lithography techniques, thereby increasing the competitiveness of the UK semiconductor industry on a global scale. Such government backing is crucial for fostering a sustainable and resilient semiconductor supply chain.